The sports betting market is a notoriously competitive search environment, but just what is going on in this particular sector – which brands are the most visible, which brands are generating the right amount of traffic, and why?

We looked at the top 989 non-brand keywords (by search volume) in the sports betting market over the course of the last 12 months. These keywords accounted for an average monthly search volume of 741,130, and an estimated maximum available traffic of 178,835 (the maximum a brand could expect based on number one rankings for all keywords and an estimated click-through rate).

Oddschecker is the most visible brand across sports betting

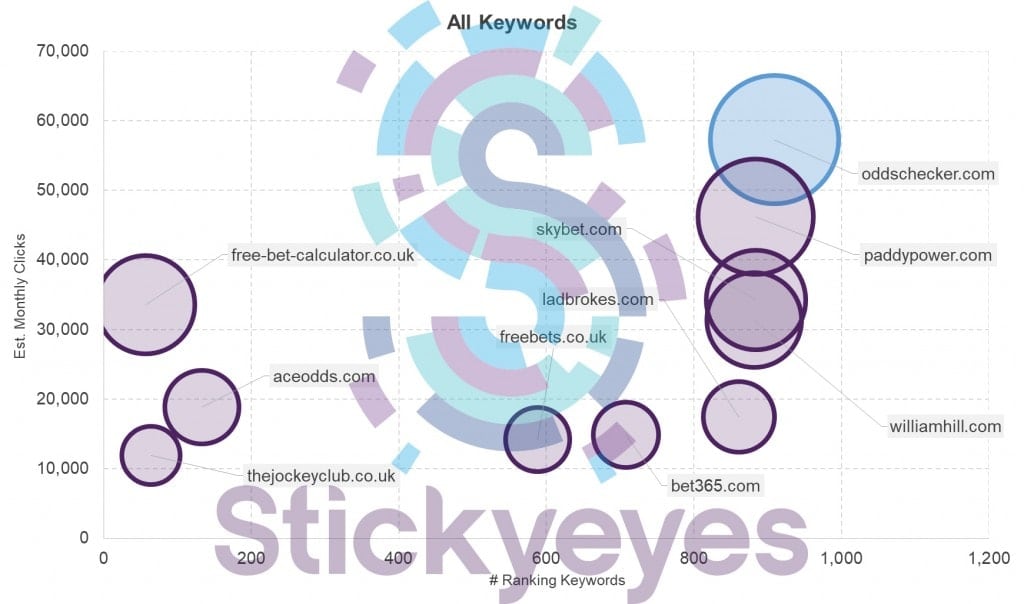

Oddschecker was the most visible brand across the sports betting market, generating an estimated traffic of 57,273 from organic non-brand search.

One of the key reasons behind Oddschecker’s visibility is its broad keyword coverage. Overall, the brand ranks for 92% of the 989 keywords in our analysis and when we look at individual sport keywords, it ranks for 98% of football keywords, 96% of keywords in horse racing, and 100 of golf, boxing and tennis keywords.

Oddschecker ranks in the top three for more than half of the keywords in our sample (572) and in position one for 374 of these – underpinning its strength in the organic search market.

A “big three” has emerged to chase down Oddschecker – and others need to keep up

Chasing Oddschecker is something of a “big three”, with Paddy Power, William Hill and SkyBet all tightly clustered together in our analysis after driving similar volumes of traffic from a similar volume of keywords.

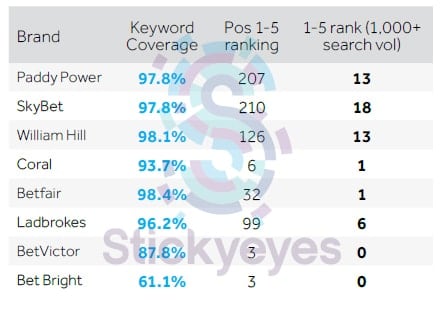

The three brands all rank for 89% of the keyword set, with Ladbrokes behind on 87%. However, Ladbrokes in particular is harmed by poor rankings in the football SERP when compared to their three competitors.

Despite having coverage across 96.2% of the keywords in the football market, Ladbrokes has just 99 top five rankings – less than half that of Paddy Power and Sky Bet. Importantly, just six of those keywords have a search volume in excess of 1,000 – compared to the 13 of William Hill and Paddy Power, and 18 of Sky Bet.

Betfair suffers from a similar problem of broad keyword coverage, but poor rankings. It has the most diverse spread of keywords in our analysis, but has just 32 top five rankings – only one of which is a high volume term.

Affiliates are finding it harder to rank

With the exception of Oddschecker, there is notable absence of affiliates in our analysis.

Previous analysis of this sector has seen a number of affiliate brands amongst the most visible domains in the SERP. Whilst brands such as aceodds.com, freebets.com and freesupertips.com do appear, this visibility tends to be based on high rankings for a very small number of high-volume terms.

The lower prominence of affiliates in our 2017 report suggests that this approach and strategy may no longer be sustainable for all but the most trusted of affiliate brands.

Events are the biggest opportunity for brands to grow

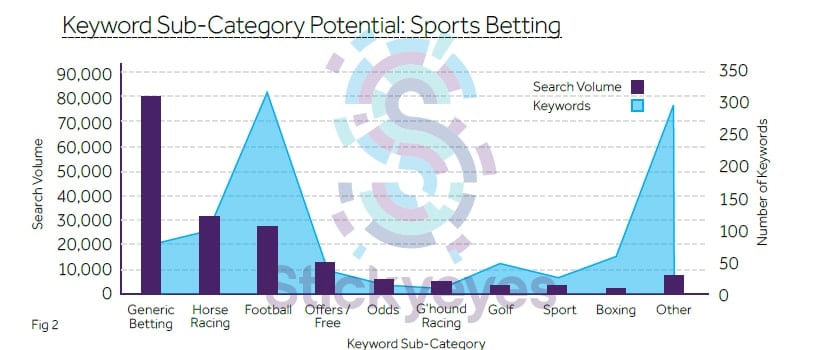

High-volume generic keywords naturally play a huge role in organic visibility and driving traffic, but the diverse nature of the sports betting market means that they are a relatively small part of the sports betting market.

The term “betting” is the only keyword with a search volume in excess of 100,000, and it alone accounts for 18% of the total search volume.

But more than 57% of the keywords in this market have an average monthly search volume of less than 100, whilst 28% of the search volume is driven by keywords that have a search volume between 500 and 5,000.

Looking at individual sports, 32% of the top traffic-driving keywords relate to football, whilst 105 keywords relate to horse racing – with most volume being driven by event terms relating to the Cheltenham Festival, Grand National and Royal Ascot.

The boxing sub-category is particularly notable for being event-driven, with so-called “box office” fights really driving spikes in activity, rather than any predictable schedule of events.

In the period that we analysed, this was seen with the Anthony Joshua vs Wladimir Klitschko fight that took place at Wembley in April 2017. As a result of this event, keywords relating to Anthony Joshua in particular grew to prominence. The term “anthony joshua odds” became the third most valuable search term in the boxing sub-category, behind the two leading generic terms in the category (“boxing betting” and “boxing bet”).

Is sports betting following the same trend that we saw in financial services?

The dominance of Oddschecker in this market is reminiscent of how we now see price comparison websites dominating many financial services SERPs. This raises key challenges for bookmaking brands who may be looking to compete with Oddschecker and similar services, who clearly have a strong user proposition (in terms of providing users with the best pricing options). The way that affiliates operate in the market is currently the subject of some debate. At the time of writing, SkyBet had announced that it would be closing its affiliate scheme in the light of regulatory changes, but where Oddschecker stands out as an affiliate is that it has a strong brand, good breadth of content and a strong degree of customer trust.

Financial services brands have been hit hard by the rise of price comparison services, who dominate almost all major non-brand search results in that sector. Whilst it is perhaps premature to suggest that Oddschecker may assume that role in the betting market, it would also be prudent for bookmakers to at least entertain that possibility, and consider how they replace the traffic that they may lose to Oddschecker in organic search.

Stickyeyes has worked with the financial services sector to find a solution to the dominance of aggregators in that sector, and whilst those solutions could represent something of a blueprint for the betting sector, it is a change and a challenge that bookmaking brands should start exploring at the earliest possible opportunity in order to protect their organic visibility.

Want to learn more? Get your copy of the full analysis at https://www.stickyeyes.com/intelligence/sports-betting-intelligence-report/