The new tax year also brings with it a new ISA year, with banking brands clamouring to put themselves in the frame for customer investments. Unfortunately for those banks, the comparison engines are very much are dominating the search results.

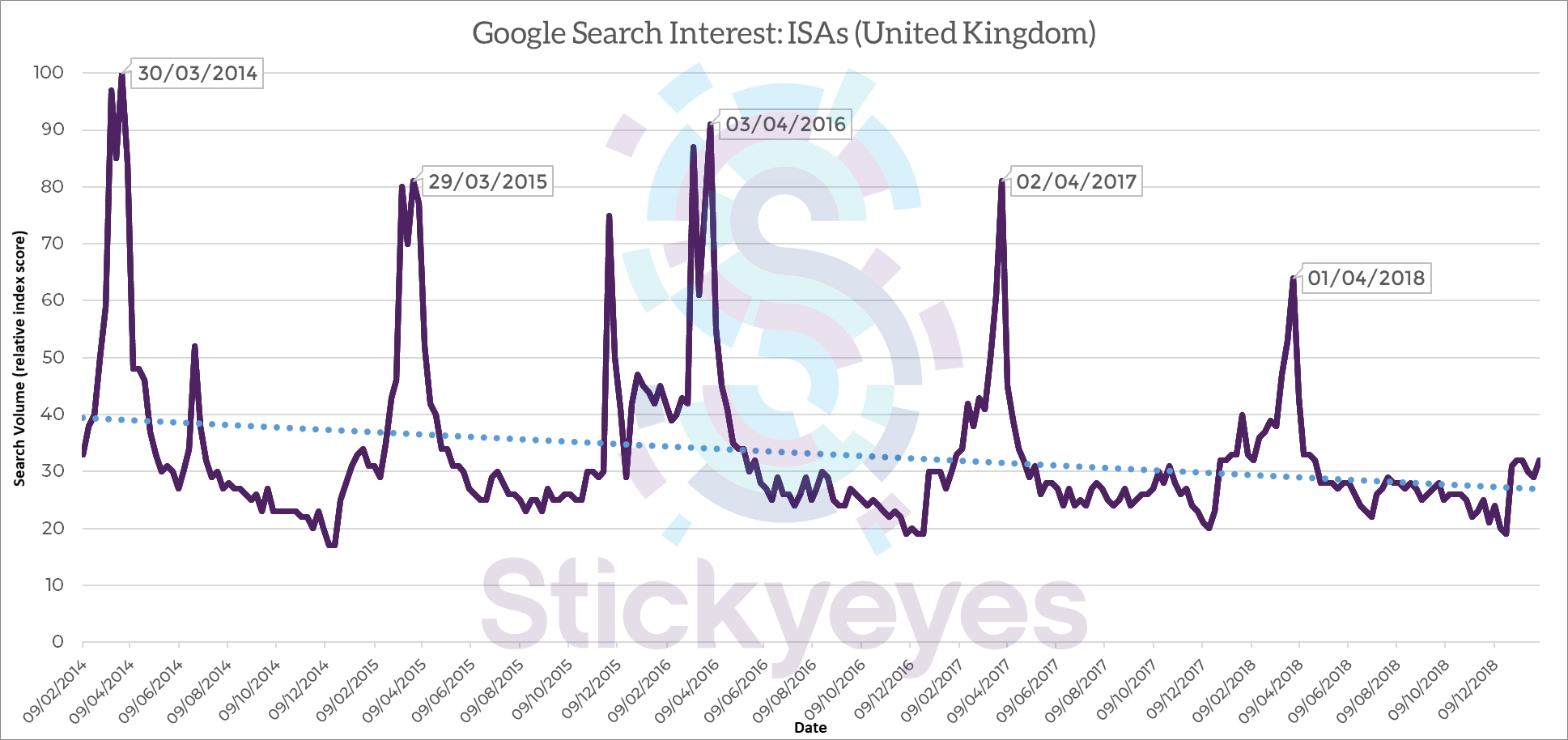

April and the new tax year represent the peak period for banking brands to attract the interest of savers looking for tax-free investments. As the ISA tax-free allowance renews, search interest in ISA-related search terms experiences a season peak in late March and early April, making it a peak period for banking brands to capitalise on increased demand in the market for traffic generation and customer acquisition.

Search interest in ISA products grew steadily between 2004 and 2013, but search interest since then has shown a slight downward trend. Much of this is attributable to relatively poor High Street interest rates, changes to how savings interest is taxed (introduced in 2016) and an increase in the cost of living relative to earnings but despite this decline, the spikes in interest in late March and early April remain.

Whilst ISA products are not necessarily effective at driving profitability for banking brands, bands do use them a mechanism for new-customer acquisition – particularly challenger banks that are looking to grow their customer base. These products then act as an opportunity to cross-sell more profitable products and for that reason, March and April can be a key period for financial services institutions.

The dominance of the comparison websites

The challenge for many of the High Street banking brands does not come from their competitive cohort, but from price comparison and money advice websites. These brands have dominated the search market for a number of years, growing to particular prominence in the year’s following the banking crisis of 2007/08, and they have made it particularly difficult for the traditional brands to generate traffic from organic, non-brand search.

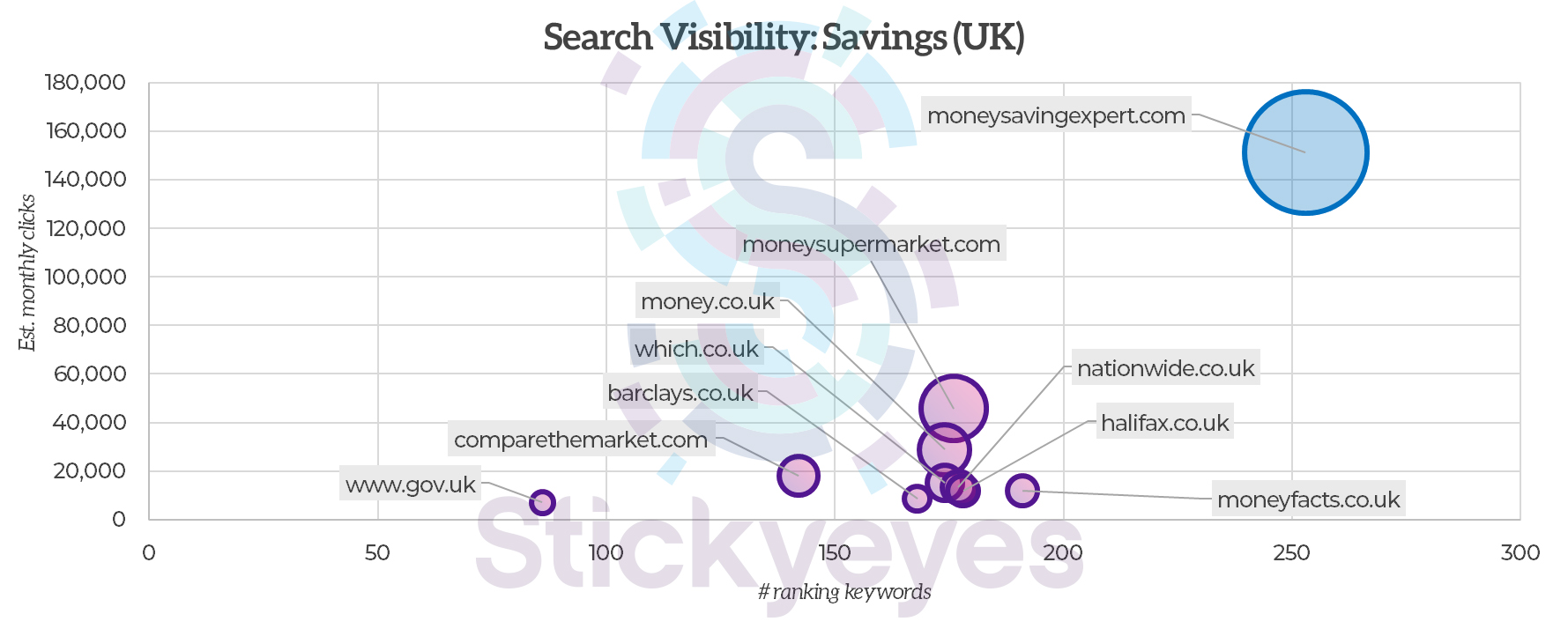

But when we analyse the search market ahead of this peak period, it is the scale of visibility that the price comparison and advice websites have over the banking brands.

Of the ten most visible brands in the savings sector, based on the 166 biggest traffic-driving keywords in this sector, six of them are price comparison or consumer advice websites. The seventh most visible ‘brand’ is gov.uk, leaving just Nationwide, Halifax and Barclays as the three most visible banking brands.

With the exception of MoneySavingExpert.com, which is the clear leader in this market, there is a large amount of competition in the market, with Barclays, Nationwide, Halifax and Which all generating a similar level of search visibility from a similar number of keywords. Money.co.uk and Money Supermarket also rank for a broadly similar number of keywords as these brands, but outrank the competition on some key high-volume terms – most notably terms prefixed with comparison-intent terms such as “best” and “compare”.

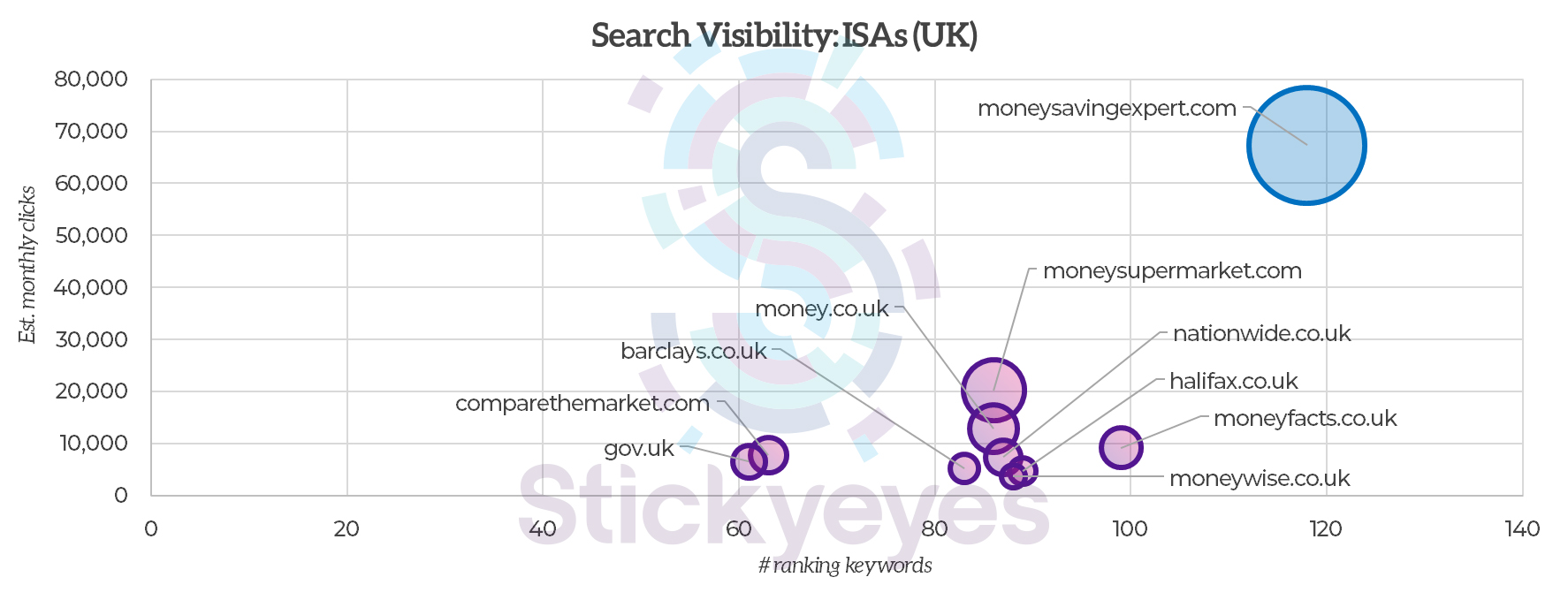

The pattern is similar when we look at ISA-related keywords in isolation (of which there are 82), with MoneySavingExpert.com generating more than three times the estimated clicks than the second-most visible brand, Money Supermarket.

The consumer magazine brand Which does drop out of the ten most visible brands when we look exclusively at ISA keywords, replaced by Moneywise.co.uk, but despite this the scene is generally similar – a cluster of brands generating similar traffic levels from a similar number of keywords.

Content and authority behind the dominance of MoneySavingExpert.

MoneySavingExpert is the clear leader in the savings and ISAs markets, and a large part of this is down to both the volume and quality of the content that the brand provides across these product areas, which in turn helps the brand to establish that all-important authority.

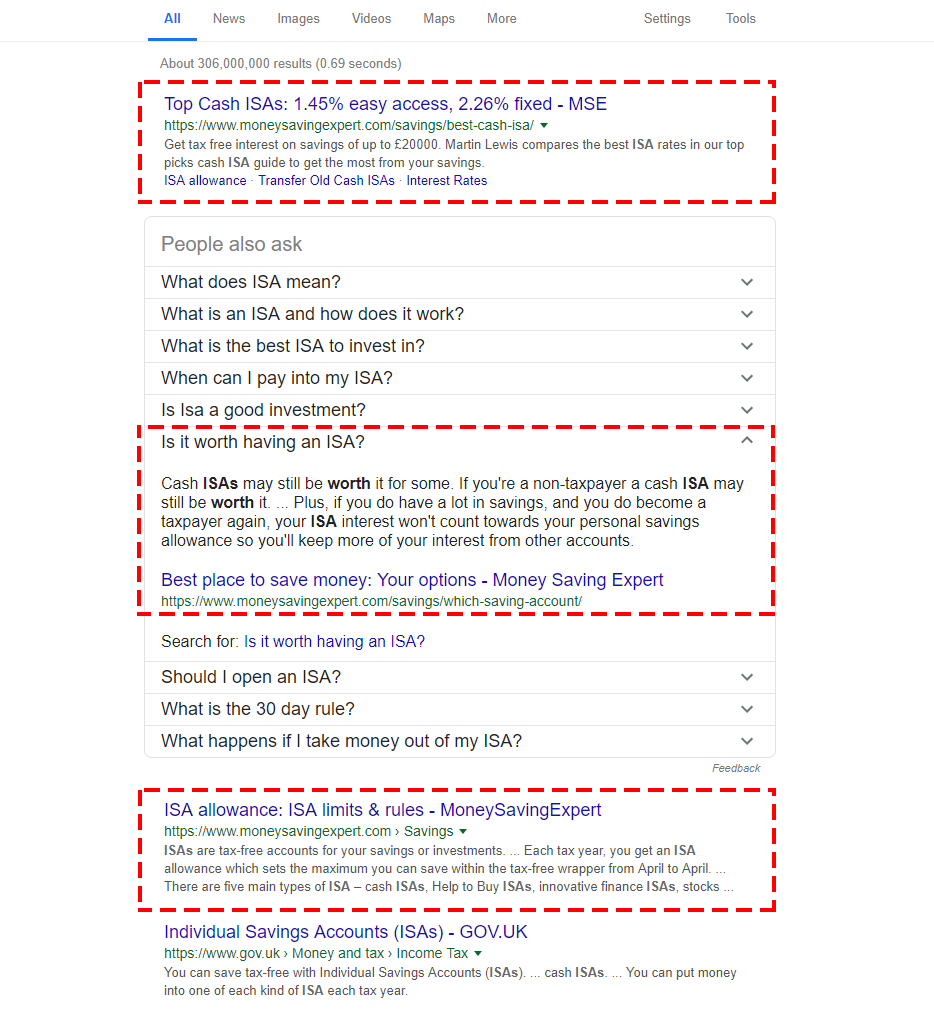

There are a number of occasions where the brand ranks multiple times for the same keyword, with different types of content. For example, in the search results page for the term ‘ISA’, the brand appears in positions one and two with different pages, as well as in a Google answer box.

What this search result shows is that a brand like MoneySavingExpert is able to deliver content that is relevant across different stages of the customer journey. For a very generic, top-level keyword such as “ISAs”, it is difficult for Google to understand the user intent behind that search, and MoneySavingExpert has capitalised on this. What we have here is a first search result that is very much conversion-focused, providing information on the ‘best buy’ deals currently on the market.

The second, answer box result is clearly focused on an audience that is at the consideration stage of the purchasing journey, considering an ISA but looking to understand whether it is the right product for them.

The third result is much more informational, looking to provide detail around the ISA rules and investment limits.

By providing this wealth and breadth of content, much of which has very little or no commercial intent behind it, MoneySavingExpert is able to establish itself as a trusted authority in this particular market. When we consider the principles that form the basis Google’s Search Quality Evaluator guidelines and the context of the so-called ‘EAT update’ of August 2018, we can start to see how the impartial, researched and non-commercially focused content provided by MoneySavingExpert can justifiably rank in prominent positions.

Are commercial brands being squeezed out of the market by EAT?

In many respects, this isn’t a fair fight. For comparison and money advice websites, it is very easy to provide impartial advice, to compare the best products on the market and to create an environment that consumers can trust. It is, after all, their entire USP.

The marketers behind the banking brands do not necessarily have this luxury. They have a much more limited product range to talk about, very few of them have the ‘market leading’ rate or product that they can talk about, and commercial expectations from the boardroom can usually necessitate that they have to produce content that convinces and converts, sometimes at the expense of content that advises.

So in the context of EAT update, it appears to be much easier for the comparison and advice websites to tick the boxes of what Google is looking for.

However, even in markets where comparison websites are becoming a prominent part of the search results, commercial clearly do have their place. The issue is in understanding where that place is, where a commercial brand can speak with more authority than a comparison or advice website, and where a commercial brand can offer a better user experience.

More often than not, that ‘place’ is further down the customer journey. For all that the comparison and advice websites can provide just that – comparison and advice – they cannot easily facilitate the transaction that the user is looking to complete. In many respects, banking brands shouldn’t be unduly concerning themselves with those high volume generic terms, but instead focusing their efforts on the content that those users who are likely to convert are looking for.

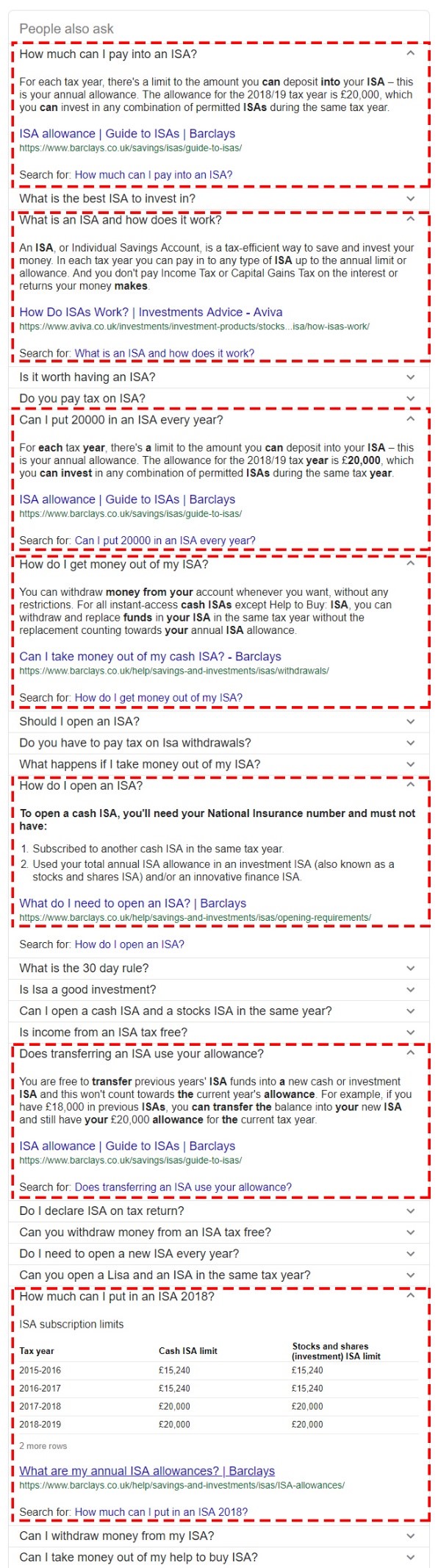

Barclays, and to a lesser extent, Aviva, are examples of a brand that seems to understand this, particularly given how they have been able to generate significant levels of visibility in the Google Answer box results, even on high-volume terms.

Both Barclays and Aviva have prominent positions in the search results for the keyword “ISA” through the answer box, achieved by producing volumes of content specifically around “question and answer” search terms.

These types of queries are typically made much further into the customer journey and demonstrate a level of consumer intent that most generic keyword terms lack.

Halifax, which also appears amongst the ten most visible, drives a lot of its visibility for specific ISA products, particularly Children’s ISAs. This, again, is perhaps reflective of a strategy to target particular products and consumer intents, rather than focusing on those competitive generic keyword terms that they’re less likely to generate traffic from due to the strength of the comparison websites.

So how do brands generate visibility?

The issue is ultimately one of quality vs quantity. Whilst search marketing is often talked about as a volume game, measured in terms of quantitative metrics like traffic and page views, it is the quality of the traffic that makes the difference.

The days of commercial brands dominating the top of the funnel are long behind us. The comparison and advice websites will always be able to provide greater levels of authority, more impartial content and benefit from greater levels of consumer trust at that stage in the journey.

But banking brands can generate more of the right visibility and traffic by focusing on the specific products that they have and the specific needs of their consumers. Whilst product-specific keywords or informational keyword searches may generate less volume, they also generate proportionately less leakage from the funnel.