Which brands are leading the market when it comes to search marketing and the legal sector? We took a closer look at the UK medical negligence sector to find out.

Which brands are leading the way when it comes to the UK legal services sector? Our latest intelligence report took an in-depth look at the medical negligence market to find out which brands were generating traffic from search, and why.

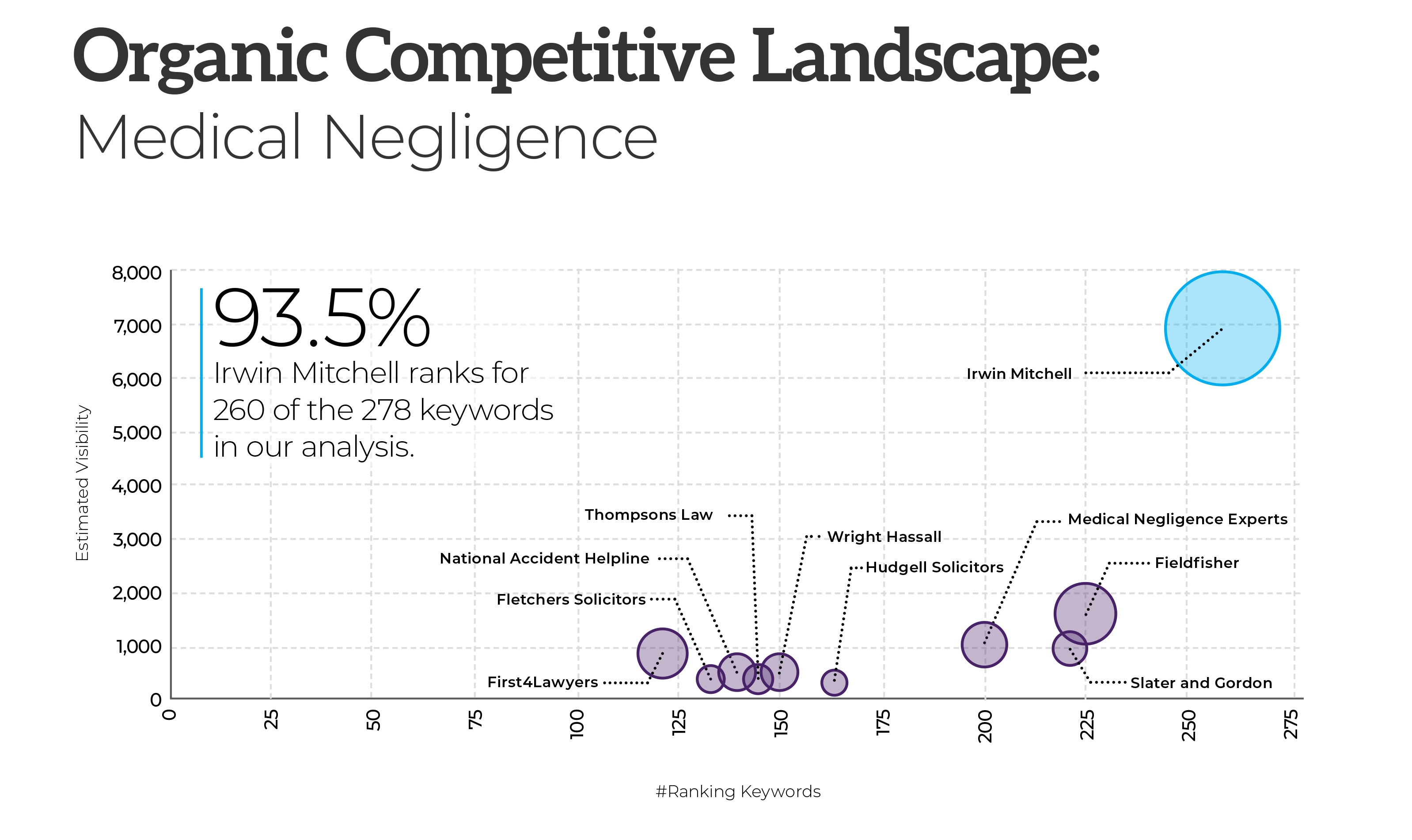

Irwin Mitchell leads the market, with competitors struggling to keep pace

Irwin Mitchell leads the organic search market by some considerable margin. The brand generates an organic non-brand visibility of over 7,000 in the medical negligence market – more than than the next 20 brands in the market combined. The second most visible brand, Fieldfisher, has a visibility of just over 1,600.

Medical Negligence Experts and Slater and Gordon are the third and fourth most visible brands respectively, both generating a visibility of just under 1,000 from organic non-brand search keyword terms.

Some brands have been able to establish strength in the search results for certain segments of the medical negligence sector, with Fieldfisher ranking particularly strongly for keywords pertaining to misdiagnosis and generating good visibility from these keyword terms. National Accident Helpline ranks in prominent positions for keywords related to dental negligence-related claims whilst Leigh Day ranks prominently for keywords around cerebral palsy. Slater and Gordon has a number of prominent rankings for hearing loss-related claims - a keyword segment that does have some overlap with industrial injury-related searches.

However, it is fair to say that in the main, brands are focusing their efforts around the high-volume generic keyword terms. Whilst these keywords generate high traffic levels, they are very competitive and in a search environment where one brand clearly has a much stronger presence, it can represent a missed opportunity to generate qualified traffic that may, in many cases, have a greater propensity to convert into an active lead or claim enquiry.

Strong content strategy secures traffic for commercial and non-commercial terms

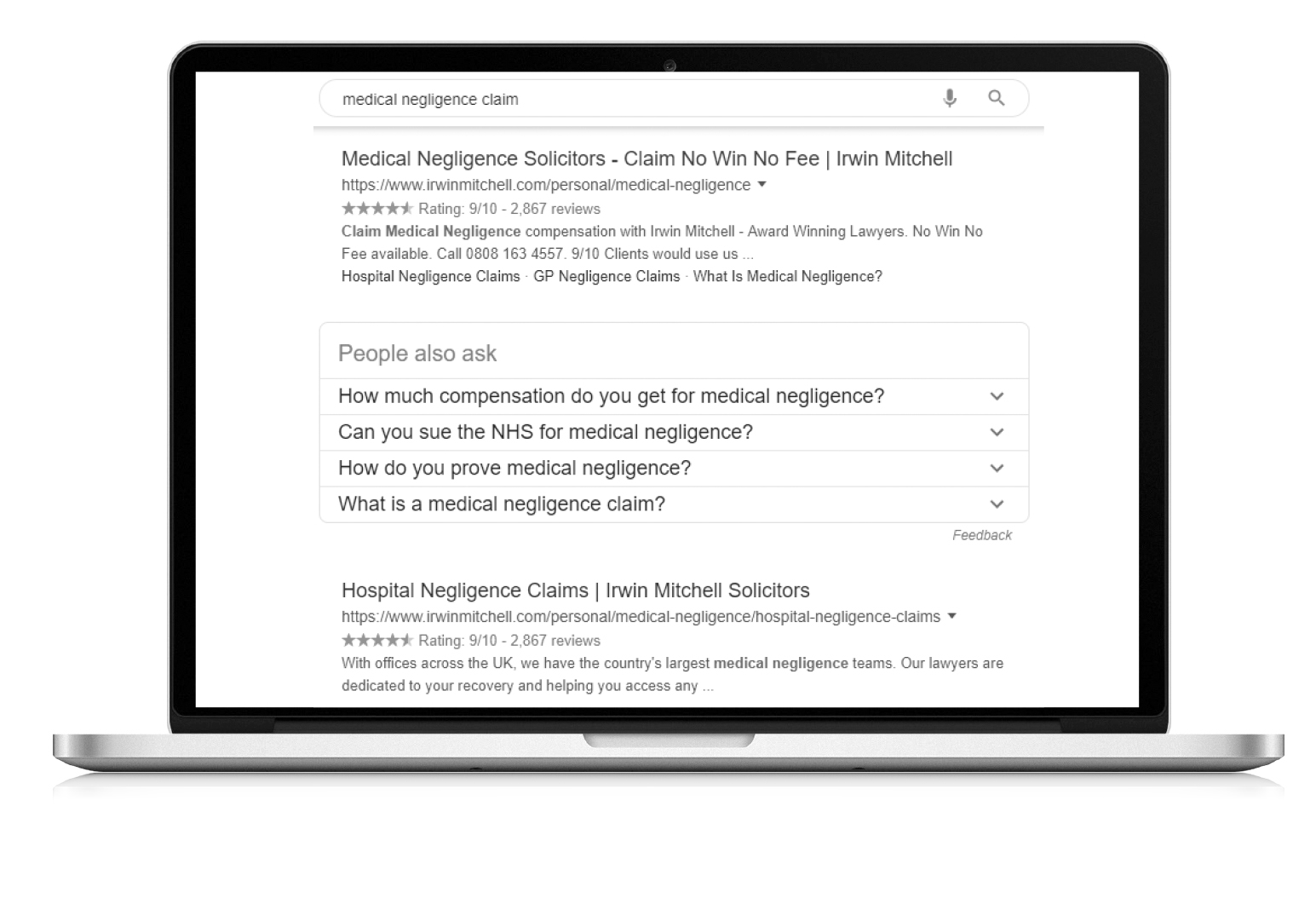

Irwin Mitchell’s dominance in the organic search market is underpinned by prominent rankings for high volume keywords and, in many cases, multiple rankings for the same keyword.

There are multiple cases where Irwin Mitchell has both a position one and a position two listing for prominent, high-volume keywords, including for:

- “medical negligence solicitors”,

- “medical negligence claim(s)”,

- “medical negligence”,

- “medical compensation”,

- “hospital negligence”,

- “medical negligence lawyers”.

These pages typically see Irwin Mitchell rank for both a commercial page result (a page that focuses on the brand’s services and proposition for the purposes of lead generation) and an informational page result, where the brand provides content provides advice and guidance on the issue related to that keyword, with less of a commercial focus. For example, for the keyword “medical negligence”, the highest-ranking result is from Irwin Mitchell for a page entitled “What is Medical Negligence? Compensation Guide”. This page provides advisory and informational content for the search user, with minimal sales focus and non-intrusive calls to action.

In producing this content, Irwin Mitchell is attempting to establish trust in a sector where audiences may be lacking in knowledge on the subject or may be considered somewhat vulnerable (having been, or knowing somebody who has been, involved in a distressing situation). This is very much in line with the approaches recommended in Google’s Search Quality Evaluator Guidelines, which are particularly pertinent in a market such as this.

Read more about these guidelines in our Google EAT guide.

Brand authority and relevance key factors in organic search

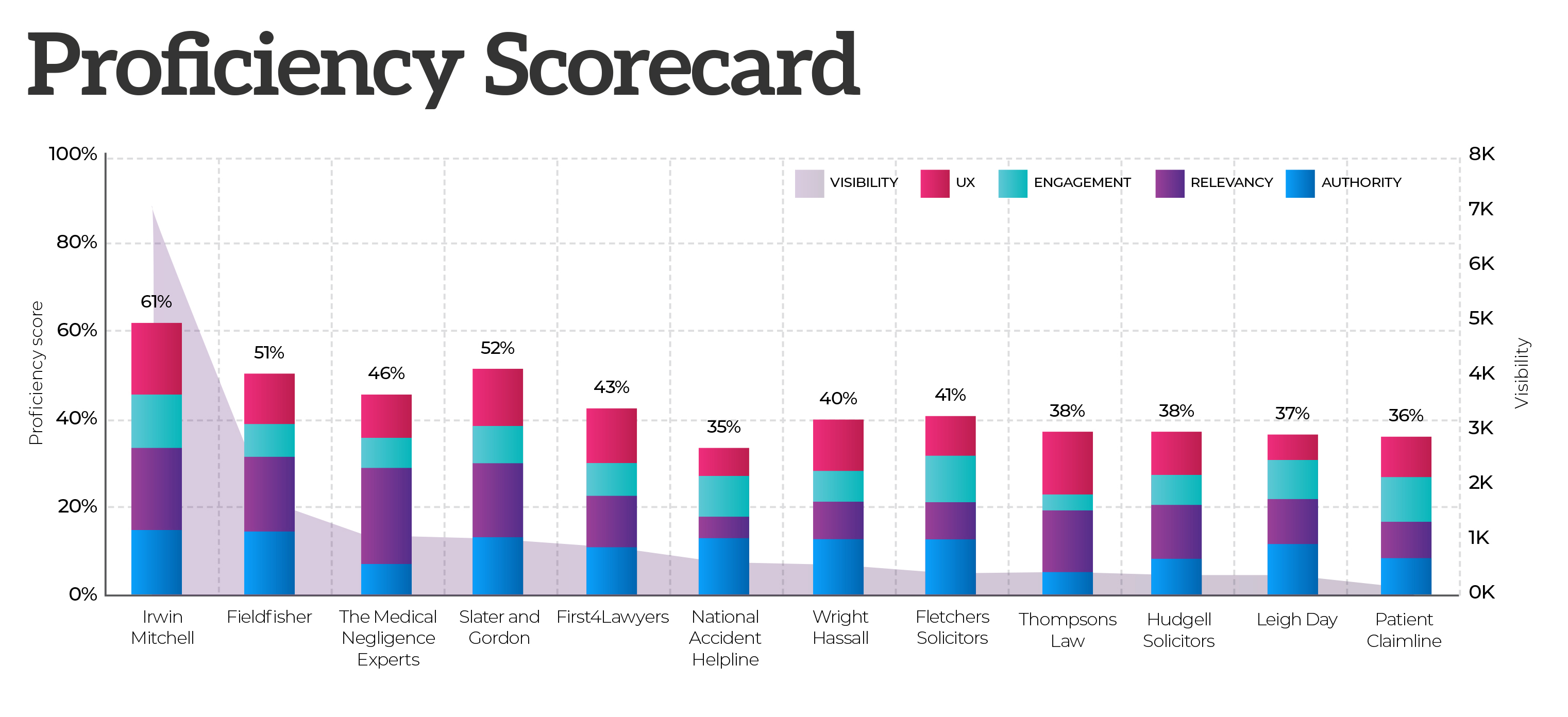

The story behind Irwin Mitchell’s dominance in the organic search market comes to life when we look at how the brand performs on many of the factors that influence authority, quality and trust – three areas that we know are part of Google’s ranking algorithm. These factors include user experience (UX), engagement, relevancy and brand authority and by combining these factors, we can attribute a search proficiency score to each brand.

Irwin Mitchell has much stronger levels of authority in this sector than many of its competitors, and this is a notable factor in its position in the market. The brand has the highest domain authority (a measure of how trusted and established the domain is) of all of the brands in our analysis. Irwin Mitchell also has the most diverse back-link profile (the make-up of the links pointing to the brand’s pages and domain) and has by far the highest level of brand awareness from an organic search perspective.

One of the key factors that determines how highly a brand scores in the areas of authority, relevancy, engagement and trust is the quality of content hosted on that domain and its pages. This is an area where Irwin Mitchell has a particular advantage many of its competitors.

The brand has close to 13,000 pages of content across its domain – more than any other brand. Only Fieldfisher comes close in terms of volume at around 12,400. Those pages also have substantial volumes of content, averaging more than 15,000 words of body copy per page.

These important engagement metrics establish the brand as a source of credible, relevant content that serves the needs of the audience, and this is reflected in the brand’s search visibility.

PPC providing a route to market but it needs to support, rather than replace, organic visibility

There are a number of brands in the medical negligence sector using paid search and pay-per-click (PPC) as a tactic to make themselves visible in search, apparently making up for a lack of visibility in organic search.

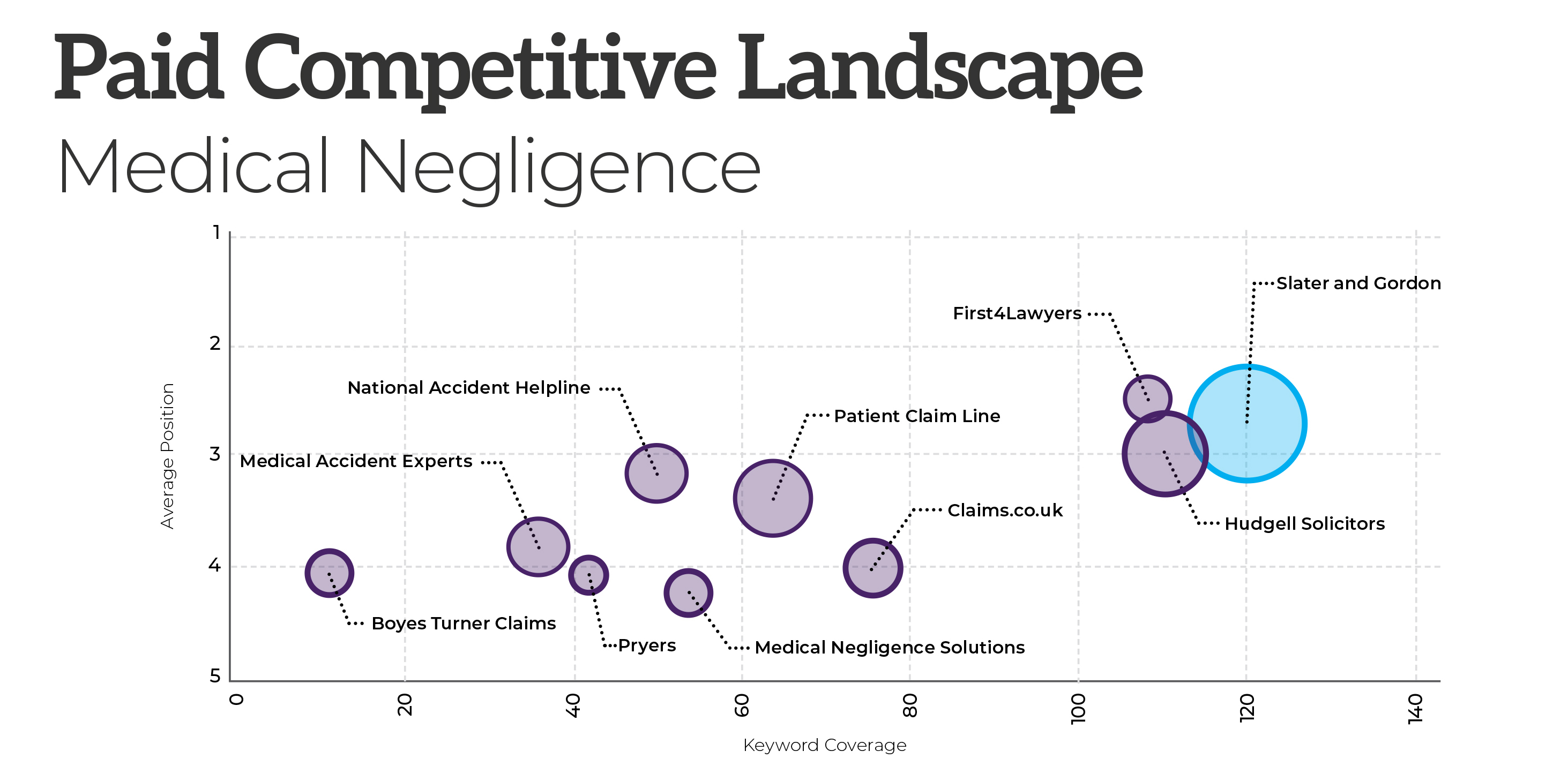

Slater and Gordon is one brand that appeared to be missing out on a number of opportunities in organic search and is attempting to make up for that organic underperformance through paid search traffic. The brand has a 60% ‘share of voice’ – a measure of its average position in paid search across all of the relevant keywords during our sample period. We estimate that Slater and Gordon is generating a search visibility of around 1,100 from paid search activity.

Hudgell Solicitors is the second-most visible brand in paid search, with 42% share of voice, followed by Patient Claim Line, at 34%.

By comparison, Irwin Mitchell is notably absent from the paid search market in the medical negligence sector.

This is to be expected to a degree, given how the brand dominates in organic search. By not being involved heavily in the paid search market, the brand isn’t putting itself at risk of paying for traffic that it may have generated at zero cost from organic search, but it does mean that the brand is relying on organic search terms to generate traffic in this area.

The challenge isn’t insurmountable

As our proficiency scoring demonstrates, many brands do have good foundations for success in organic search and, through a number of adjustments to their organic search strategy, could significantly improve their organic search visibility.

Many of the competitors to Irwin Mitchell score highly in areas of our proficiency analysis, particularly on relevancy and user experience. What our analysis shows is that many of the issues facing the brands that are trying to compete appear to be rooted in issues around engagement, authority and brand awareness.

Content will play a role in many of these issues. In these circumstances, brands have the potential to challenge Irwin Mitchell for that visibility by adapting their content and search strategy to focus more heavily on issues such as user intent – a key factor in the Google search algorithm.

Many brands in the medical negligence sector have the right foundations in place to generate good levels of traffic from organic search in the medical negligence market – and the right strategy can help them to build on those foundations to generate greater volumes and a greater quality of traffic.