It is important to frame the current COVID-19 outbreak relative to previous epidemiological or economic crises such as SARS (2003), the global financial crisis (2008) and the lesser MERS epidemic (2012).

COVID-19 is already more pervasive and economically impactful than SARS - the WE Forum estimating coronavirus will cost the world economy between $1 - 2.7 trillion – compared to $40 billion for the SARS epidemic. ($56 billion in 2020 based on inflation).

This is compared to the global financial crisis of 2008 thought to have cost the US economy $1.4 trillion alone.

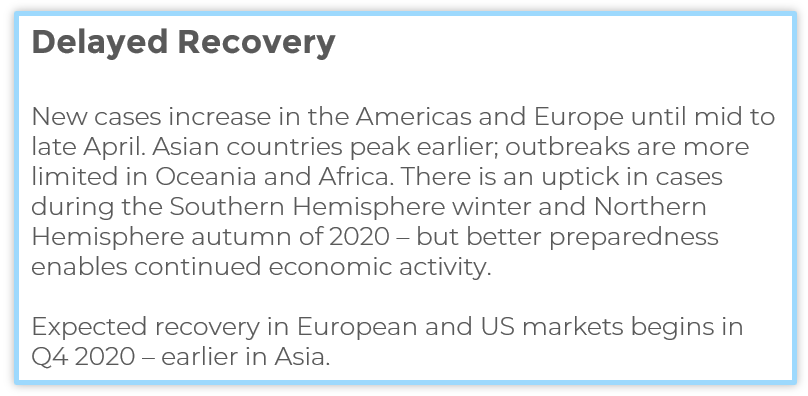

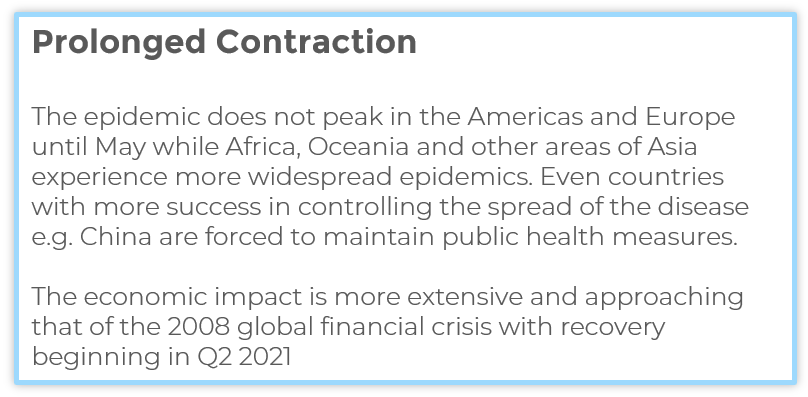

McKinsey, with guidance from data from the WHO and other medical institutions suggest two broad scenarios could play out.

Sources:

https://www.ncbi.nlm.nih.gov/books/NBK92473/

https://www.weforum.org/agenda/2020/03/coronavirus-covid-19-cost-economy-2020-un-trade-economics-pandemic/

https://www.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business

So what should brands do in response?

Business survival and employee and public well-being are the most important pillars of any company’s response to COVID-19.

While currently marketers and ad agencies are quick to extoll the virtues of continuing comms through a financial downturn this should of course be judged on a case by case basis for each business and brand.

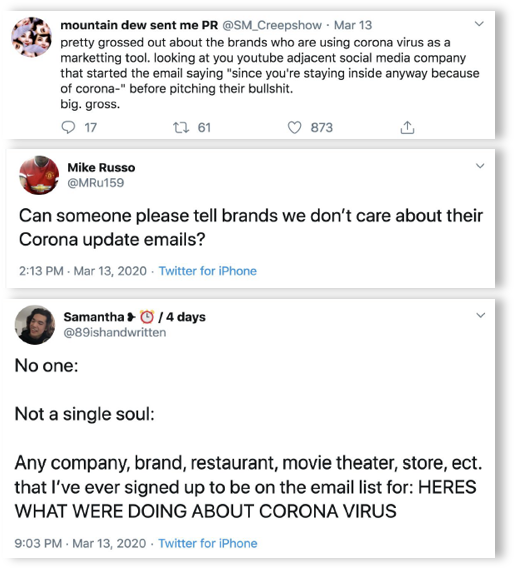

An overriding and quite obvious message from both industry reports and public opinion derived from social conversations is that where businesses are continuing to communicate during the pandemic they must not be seen to be profiteering from the crisis.

Instead, providing simple, clear helpful guidance that although may carry with it the values of the brand, does not do so in a self-congratulatory or promotional way.

Sources:

https://www.marketingweek.com/coronavirus-long-term-brand-building/

WARC, How to adapt your strategy during the coronavirus lockdown and what to anticipate after the crisis is over, March 20

BBH, Brands & COVID, How to protect your brand; A briefing for marketing leaders from BBH

It could be useful, as marketers, to ask ourselves:

- Is any marketing live now no longer appropriate?

- Is marketing about to go out no longer appropriate and are we making decisions now we will later be judged on?

- Are we listening to customers explicitly on social as well as wider trends to make sure comms are appropriate?

- Are any immediate actions couched in the benefit of people and their new needs

- Have we turned off out of home media (e.g. cinema) and pivoted to home media (OTT, social, search)

The WARC CMO Growth council describe communications as needing to demonstrate ‘story doing’ not ‘story telling’. For brands setting out on initiatives to help employees and wider society, they are encouraged to act on it, rather than just talk about acting on it.

Sources:

https://www.warc.com/newsandopinion/news/cmos-focus-on-story-doing-in-covid-19-response/43426

Recovery – a rebound across affected markets

Talks of recovery and a sector rebound have been touted and were clearly observed following previous epidemiological crises.

Most commentary has been based on modelled data derived from the SARS outbreak of 2003 – after which, within the travel sector, a 22.5% increase in like for like air travel across the Asia-Pacific region was recorded.

Research in the UK market from Kantar also suggests that for just under half of people, the first thing they would want to do after self-isolation ends, is travel (45%).

Sentiment echoed by Humphrey Ho, MD of Chinese marketing firm, Hylink.

Sources:

https://www.thedrum.com/opinion/2020/03/13/how-are-businesses-preparing-post-coronavirus-world

Kantar, COVID-19 Impact on Brands, March 20

The danger of going dark

It is clearly important that brands remain receptive to requests from consumers for information during this time – with customer service remaining key – research from business analytics firm Marketscience, based on analysis of economic downturns over the last 50 years, showing that brands that focused on customer satisfaction and service win out following recession.

Distinct from the economic crises of 2008 and earlier, brands and businesses however now face other pragmatic challenges around service fulfilment – summarized by respected marketing consultant Peter Field

“Brands have one of two problems: either they can’t meet demand because of panic buying… or they have no customers because people are not allowed to go and buy it…”

The focus for those brands not able to fulfil services, therefore being to maintain brand salience and plan ahead for recovery.

Sources:

https://www.marketingweek.com/coronavirus-long-term-brand-building/

https://www.warc.com/content/paywall/article/warc-exclusive/how-to-win-during-and-after-a-recession/130812

Field continues – that for those brands who are in a financial position to continue to communicate, plan and push comms in context of a longer term strategy towards recovery…

“We know going dark is no way forward. There is a value to society and the economy of not being seen to panic as a business. If all advertisers pull their money, the effect on consumer morale and business sentiment of the country would suffer as a result…there is a value in being seen to be an advertiser. [Going dark] would only add to the sense of crisis and panic, as well as undermining their brand in the long term.”

A survey of UK consumers by Global Web Index found that 66% of consumers felt that brands should still be advertising – of those 37% thoughts brands should advertise as normal and 29% that they should advertise, but differently.

Sentiment echoed by Kantar based on panel data in their report on COVID-19 and it’s impact on brands.

Sources:

https://www.marketingweek.com/coronavirus-long-term-brand-building/

https://www.warc.com/content/paywall/article/warc-exclusive/how-to-win-during-and-after-a-recession/130812

Kantar, How Brands Can Survive the COVID-19 Crisis, March 2020

Recovery – a time for strong brands

Commentators and marketers have tried to apply the rules of behavioral science to the current outbreak and it’s effect on consumer decision making now and in the future. A recurring theme in this analysis is our evolutionary fear of the unknown.

In times of difficulty and trauma, people naturally gravitate towards the familiar, underpinned by the increasing role government and state are playing in our everyday lives. Meaning that in times of recovery consumers are likely to look to big, trusted brands to support their journey back towards the ‘new normal’.

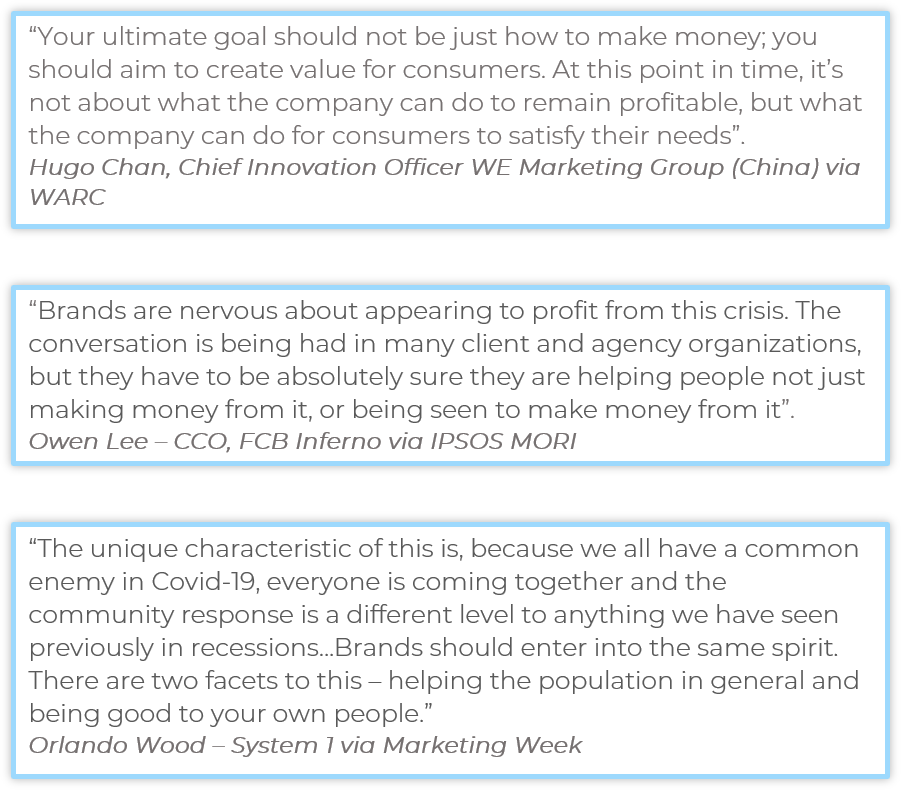

Strong brands and particularly those that maintain a Share of Voice greater than their Share of Market during an economic downturn were shown to recover 9 times faster following the financial crisis of 2007/8 according to Kantar analysis.

Marketing effectiveness consultancy Data2Decisions also found that those cutting ad budgets entirely during the same financial crisis took almost twice as long to recover as those who halved their budgets.

Sources:

https://www.warc.com/newsandopinion/news/brands-in-a-pandemic-world-insights-from-kantars-covid-19-barometer/43422

Data2Decisions, IPA – Advertising in a Downturn, 2008

Recovery – brands that can invest reap the rewards.

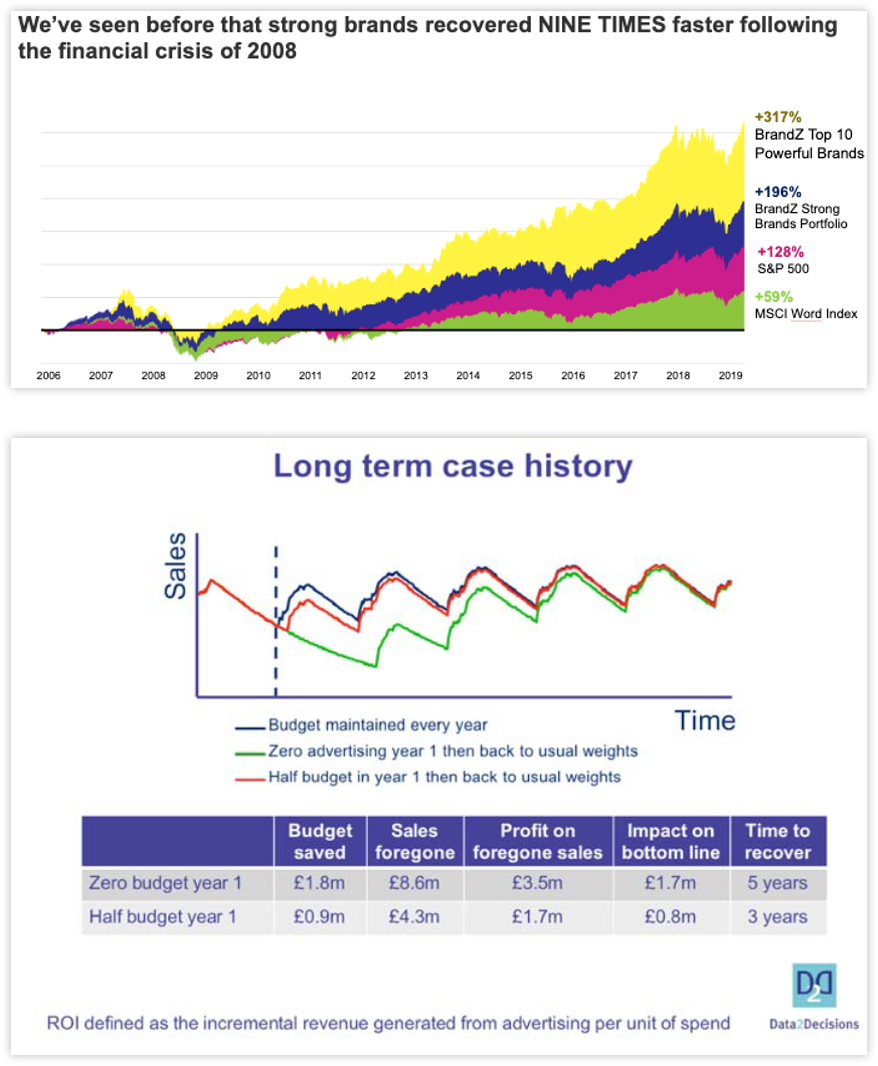

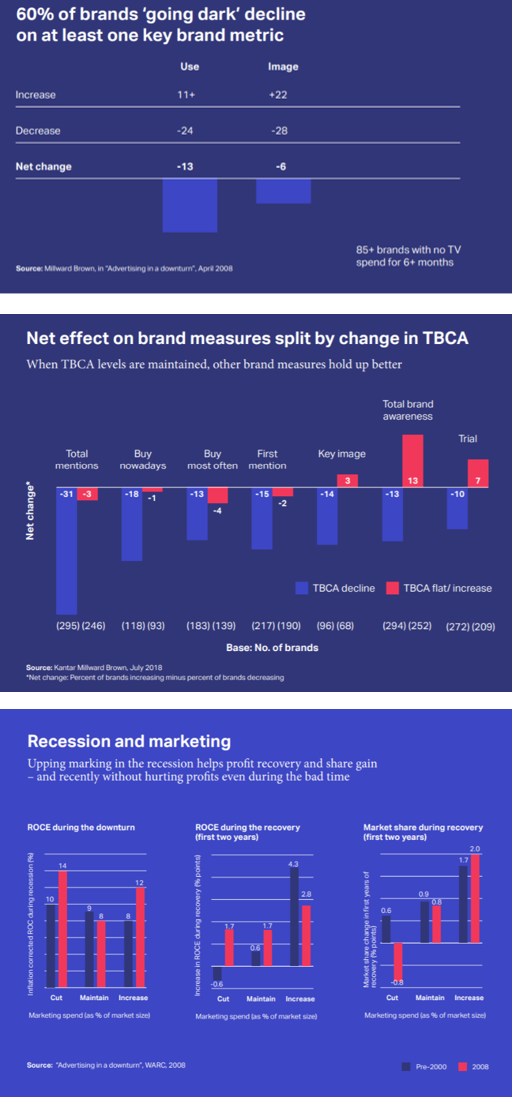

From the report ‘Advertising in a Downturn’ a summary of a seminar presented by the IPA analysing performance of brands following the economic downturn in 2008 a number of key statistics were revealed -

A strong correlation between a brand’s SOV and ad spend and its level of ‘bonding’ with consumers – key bonding metrics being popularity, affinity, leadership, differentiation and price – all suffering significantly if brands go silent for extended periods – Kantar Millward Brown

Supporting a brand in other ways if broader reach mediums like TV are pulled back can help prolong resonance of campaigns and messaging – maintaining total brand communication awareness (TBCA) levels directly correlates with maintained brand health metrics – Kantar Millward Brown

Business success in the long term measured by Return on Capital Employed (ROCE) and market share in the first two years after a downturn was generally closely linked to relative maintenance of ad spend during that period – Malik PIMS

IPA – Advertising in a Downturn, 2008

In conclusion

First and foremost, regardless of business firmographics or sector, being contactable and supportive to existing customers remains fundamentally important.

If governmental policies or more general disruption caused by the pandemic are affecting your business model or supply chain meaning trading opportunities are limited, but you have the resource (both financial and human) to continue brand communications then clearly empirical evidence suggests there are significant benefits for businesses.

For those who pragmatically cannot take this longer term view towards effectiveness but are still in a position to trade, pivoting product or distribution channels can help to mitigate against those restrictions; popularised by the numerous café and restaurant businesses now offering delivery services.

From a communications perspective, short term efficiency and lower funnel activation can and should still represent a key focus area for these businesses. (You can read more, specifically on how you can use content to 'be there for your customers' in the latest post from Danny Blackburn, our Content Director). And with that the tenets of performance marketing remain absolutely consistent:

- maximise the value of every pound invested to generate incremental revenue through targeting the most appropriate existing or emerging audiences;

- leverage messaging that appeals to shifting consumer needs and across the media audiences have been, or are now consuming the most;

- ensure brand touch points and conversion mechanisms are geared towards helping consumers complete the actions they actually determine – checkout, sign up, donation or more general content consumption.