Capitalise on the void at the top of the search results

What our report found was that was that when it comes to organic, non-brand search, there was a real void at the top of the market in terms of visibility – and this creates a significant opportunity for any brand that wants to seriously focus on search engine optimisation and generating traffic from organic search.

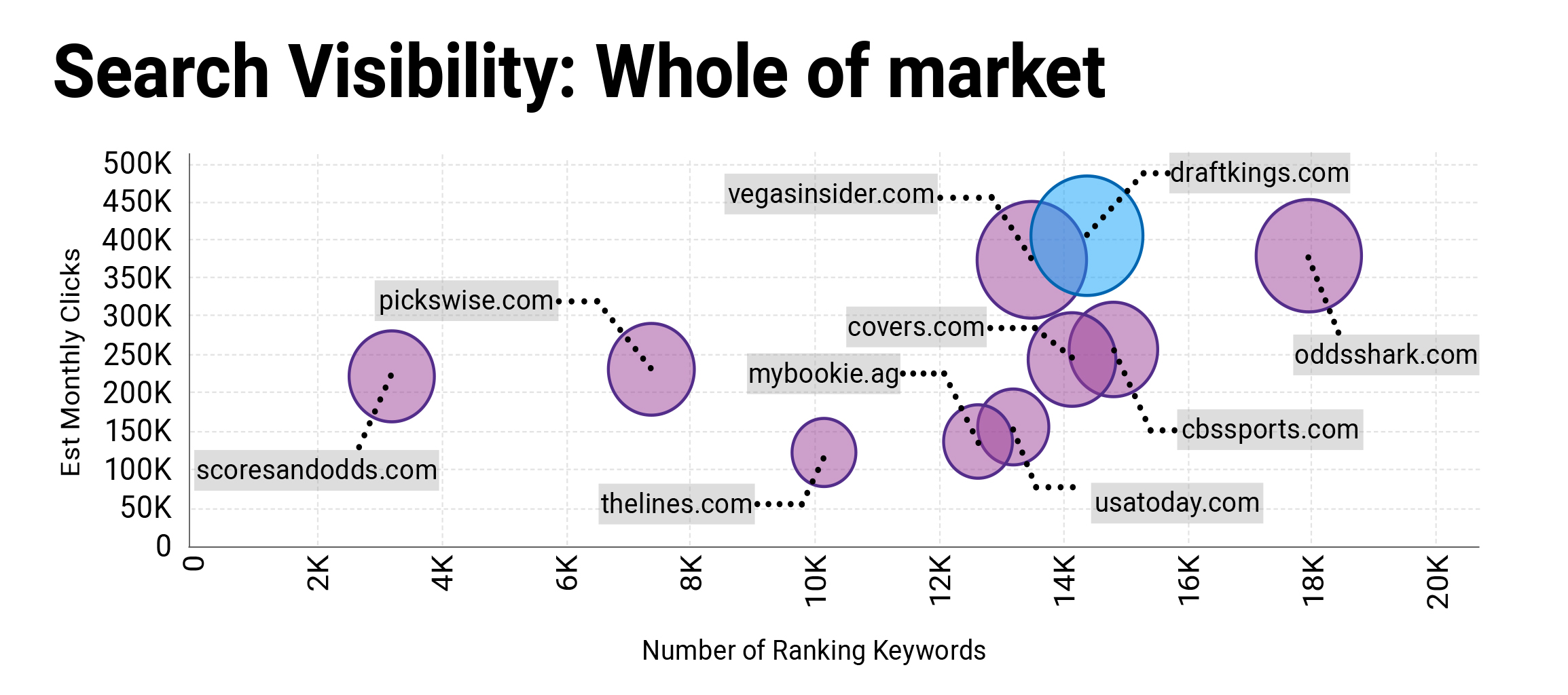

Draft Kings is the most visible brand in the market, generating traffic of around 404,505 from around 14,359 ranking positions. However, this position as market leader is far from a dominant one.

When we look at the maximum potential traffic in this sector (a theoretical maximum that could be achieved from ranking in position one for every keyword), we see that the market leader attracts just 22.9% of the maximum available traffic, and that it has a weighted average ranking of just 15.1. To put that into context, the market leader for a comparable analysis in a competitive and mature market such as the UK would typically command somewhere in the region of 40-45% of the potential maximum traffic

This apparent lack of any real and clear market leader plays out across many of the sub-sections of the market. In our report, we look at six sport-specific keyword clusters and in all but two (golf and baseball), the most visible brand in that category is taking less than 50% of the maximum available traffic from organic, non-brand keywords.

How brands can capitalise on that

What this means is that there is a very real opportunity for brands that do invest in SEO to really take control of the market and the organic search results pages. This is something we aren’t necessarily seeing at present, as many brands (particularly overseas operators from Europe) focus their investment on brand awareness campaigns and brand partnerships with leagues and franchises. This activity will have something of a positive influence in helping to build online reputation and authority in the long term, but there are significant short and medium term gains to be made by any brand that wants to use organic search as a way to grow its online traffic and visibility.

But it does mean that competition for traffic across the keyword set, including for some high-volume generic terms, remains relatively low. This will inevitably change over time, but there is a very real opportunity for brands to get something of a head start on the competition.

Even for brands without the credentials to rank for those higher volume terms, there are opportunities to drive traffic from search. Our report analysed close to 19,000 keywords and whilst many of these have low volume in isolation, within this sample there are clusters of keywords that collectively offer sizeable levels of qualified traffic, whilst still having relatively low levels of competition.

Position yourself as an online authority in this relatively immature market

One core factor behind success in organic search, particularly in a sector such as iGaming, is how brands can establish their online reputation as a trusted authority on the subjects that they are looking to rank for.

Since 2018, Google has been paying particular attention to the search results of certain markets that, in its view, require an additional layer of oversight to ensure that users remain protected from financial harm, misinformation or other online threats. The policy, known widely as the ‘Google EAT’ update applies to what Google categorizes as “Your Money, Your Life” (YMYL) search results and broadly covers sectors where consumers would have higher expectations around levels of content quality and impartiality, as well as those sectors subject to higher levels of regulatory oversight – of which iGaming is one.

As part of the policy. Google’s search quality assessors are instructed to manually appraise pages on three key areas – expertise (how skilfully has the content been created), authority (whether the site has the credentials to speak about this issue) and trust (whether the audience can trust the content). Sites are then manually rated upwards or downwards based on that criteria.

This policy is likely to be a big reason why we see so many publishing, media and affiliate sites in prominent positions within the search results for US sportsbook – certainly when we compare to equivalent search results in mature markets such as the United Kingdom and Europe.

These brands have something of an advantage in terms of a stronger brand and content proposition that tends to align with what the Google EAT guidelines are trying to achieve. In the case of some of the media brands we have highlighted, that authority can come through official partnerships and media rights agreements with the respective sports and franchises and the content itself is both well crafted, using skilled and credible journalists, and generally more impartial that what the bookmaking brands themselves are likely to offer.

How brands can capitalise on that

Many of the European markets went through a similar phase as the markets came to maturity, even if the search landscape was somewhat different prior to the Google Panda and Penguin updates in 2011 and 2012 respectively. If we look an equivalent search results analysis of a market in the UK or Europe today, we would tend to see a greater proportion of sportsbook operators in the top ten, along with just a small number of the strongest affiliate brands. These markets got to that point because bookmakers themselves focused heavily on content, creative and online authority building.

That comparison provides us with something of a roadmap for how brands looking at the US sportsbook market need to craft their SEO strategies. The brands that can establish themselves as credible authorities, brands that can be trusted by consumers and brands that can stand out with their content and creative, will be the ones that put themselves in the best possible position for those top positions.

Start with looking at the customer journey and identifying what content people are likely to need at each stage of that journey. What anxieties or concerns will they have? Will they understand the bet types? Will they understand the process of placing a bet? Will they be able to easily navigate the platform from a user experience perspective? Address those parts of the process with useful, informational and functional content that you can use to help build trust with users.

With that in place, add those important layers of engaging and advertising content to build brand awareness, increase engagement and drive traffic.

Leverage those offline partnerships with stronger online activations

The loosening of online betting restrictions in the US had led to an explosion of brand partnerships between bookmaking brands and both the leagues and team franchises. Around $400m annually is estimated to have spent on betting sponsorships in the US up to 2021 (GlobalData Sport Intelligence Center, 2021), with William Hill, Betfair, Betway, 888 and Unibet amongst the European brands that have made significant partnership agreements with both sports and teams across the National Football League, National Basketball Association, National Hockey League, Major League Baseball, Ultimate Fighting Championship and Major League Soccer. In April 2021, The NFL named Caesars, DraftKings and FanDuel as its first US sports betting partners, in an agreement worth an estimated $1bn over the lifetime of the deal.

Many of these agreements have let to some innovative offline brand activations, including dedicated “betting lounges” being opened at some stadiums and arenas, as well as more typical branding and fan engagement activations that are common around the world.

How brands can capitalise on that

How these partnerships are used to support online fan engagement is likely to be an interesting trend to follow, and much will depend on what these partnerships do and don’t allow brands to do in terms of using league and franchise assets.

What we have seen in markets such as the UK is sportsbook brands leveraging these partnerships to support their digital presence, using sponsorships to enhance their content and creative strategy, to support their online authority and credibility by association with major sporting brands and personalities, and to enhance their audience reach.

As we start to see the viewership of these sports become somewhat more fragmented, split across multiple screens and devices, and as innovations such as in-stadium connectivity improve and become more widely adopted, the way in which sportsbook brands find ways to use their position and brand partnerships to access consumers could be a significant route to engagement in the sportsbook market.

Download our free 42-page report.

As the US iGaming market opens up, just which brands are in position to take advantage of the new opportunities in organic search?

The Stickyeyes US Sportsbook Search Intelligence Report will highlight just how consumer search trends have changed as the legislative environment has evolved, highlighting the key opportunities for sportsbook operators, affiliates and publishers to drive traffic, and show which brands are at the top of the search results in the key market categories.

Having analysed close to 20,000 keywords in the homewares and home furnishings retail market, our 44-page report will reveal:

What does the search market look like in US Sportsbook?

What our analysis of nearly 19,000 keywords tells us about the state of search.

Which brands are leading the search results?

We reveal the brands that are currently leading the market and why.

How do competitors target those valuable consumers in search?

We look at the opportunities for brands in the US Sportsbook sector to grow their online presence.