The growth of budget airlines, hotel booking and price comparison websites, as well as peer-to-peer booking platforms (such as Airbnb or Homeaway), has clearly been one of the major developments in the travel sector in recent years. That growth has led to suggestions that the traditional ‘package holiday’ had lost its allure with holidaymakers, with travellers instead preferring the ‘DIY’ approach to tourism to cut out the middle man.

Click here to download our travel and holidays organic search rankings report

However, our findings seem to suggest that there is still demand for packaged travel from UK consumers and that, if anything, many brands are now starting to push their package offerings as a key selling point to generate both web traffic and bookings.

Package operators perform strongly in search results

Despite the growth of these alternative booking platforms, the package operators are still able to command a significant level of search engine real estate and visibility.

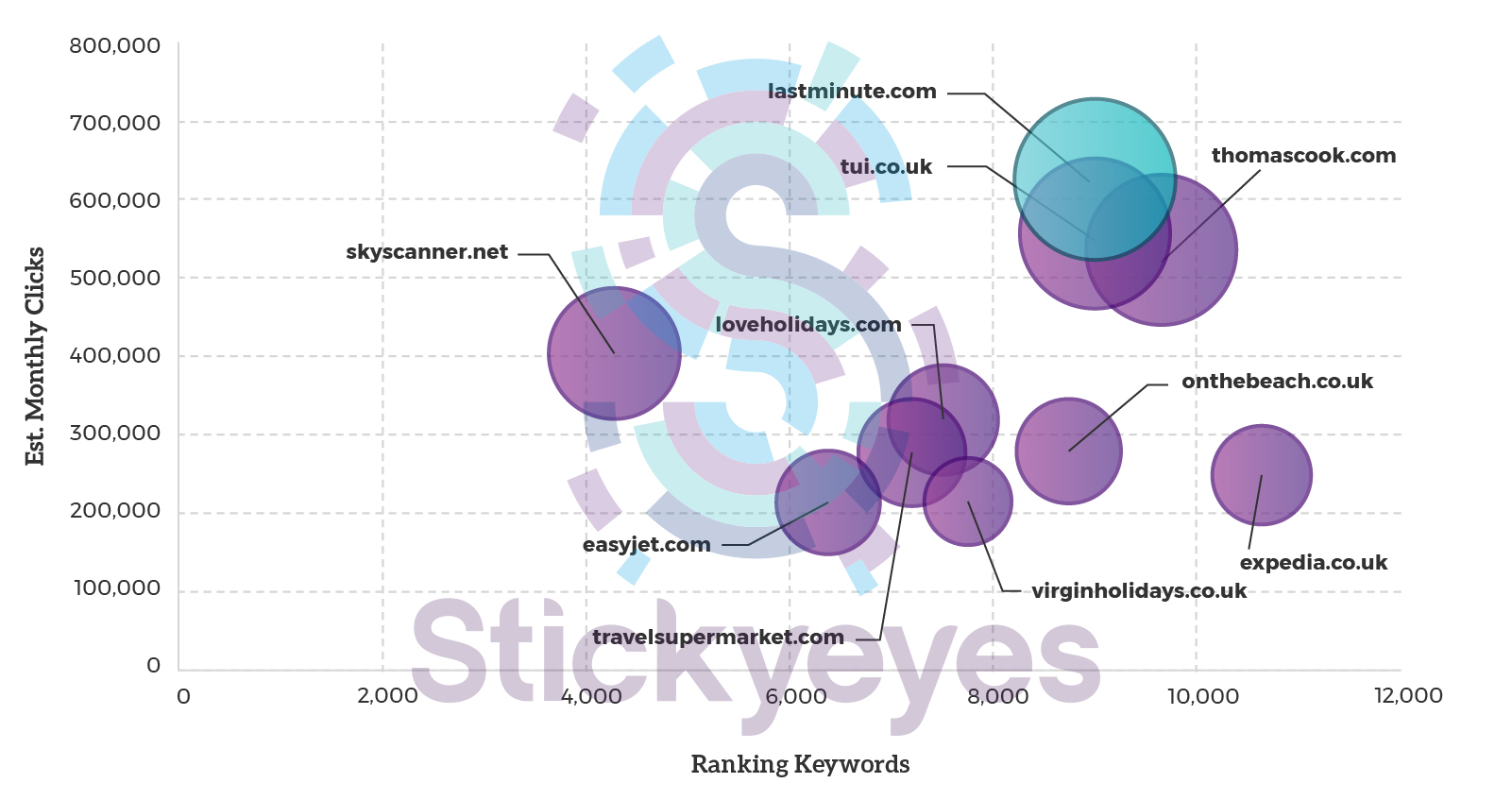

Two of the biggest brands in the UK holiday market, TUI and Thomas Cook, are the second and third most visible brands respectively in the market, based on our sample of 10,464 keywords. The most visible is Lastminute.com.

TUI and Thomas Cook both generate high levels of search visibility from organic non-brand search and they have done this by being prominent for keywords across the keyword set and, in many cases, playing to their strengths. Despite the huge levels of price-sensitivity in this market, neither brand is driving the bulk of its traffic from price-sensitive keyword terms but instead, from the keyword terms that are core to their respective customer propositions – both on generic, high volume keyword terms and on terms on specific segments of the market, such as all-inclusive holidays, city breaks, family holidays and cruises.

Other package holiday operators or sites that build different elements into a protected package offering also feature prominently in the top ten brands of our analysis. On the Beach is the seventh most-visible brand in the market, Expedia is in eighth position whilst Virgin Holidays, which is the most visible brand for honeymoon-related keyword terms is the tenth-most visible brand in the market.

Has consumer confidence pushed consumers back to the security of package deals?

The pressures facing the travel sector in recent years have been well documented. A general fall in consumer confidence, rising costs due to the collapse of Sterling, security concerns in a number of destinations and a number of high-profile financial issues in this sector have all combined to create a nervous environment for holidaymakers.

These factors have promoted a change to the way in which people appear to be searching in the travel and holiday market. Package-related holiday keywords have generally shown an upward trend in the market in recent years, whilst a joint 2018-19 report by Travel Weekly and Deloitte suggested that package holidays were out-pacing the market, fuelled partly by increased demand for all-inclusive holidays.

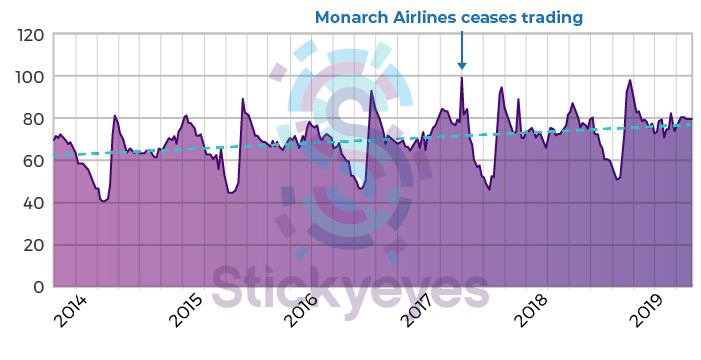

We can see a small snapshot of how this uncertainty affects search behaviour by looking at the flights market. Whilst search activity in this search market does tend to follow consistent trends, September 2017 experienced an unseasonal spike in search interest. This spike coincided with the collapse of Monarch Airlines, forcing many travellers to find alternative travel arrangements in that short period.

With these factors playing a role in consumer thinking and behaviour, package operators in particular have made the level of protection afforded by schemes such as ATOL and ABTA a much more prominent part of their marketing strategies. As consumers become more aware of concerns such as the potential for tour operator or airline collapse (since conducting this analysis the Malvern Travel Group, consisting of LateRooms.com and Superbreak, ceased trading), safety and security threats in particular destinations and currency fluctuations, the appeal of fully protected and, in the case of currency fluctuations, all-inclusive packages becomes much greater.

Airlines pushing package deals to overcome the aggregators

Low-cost airlines have been one of the biggest contributors to the growth of independent or ‘DIY’ holiday bookings, but the airlines themselves are now starting to offer their own package propositions.

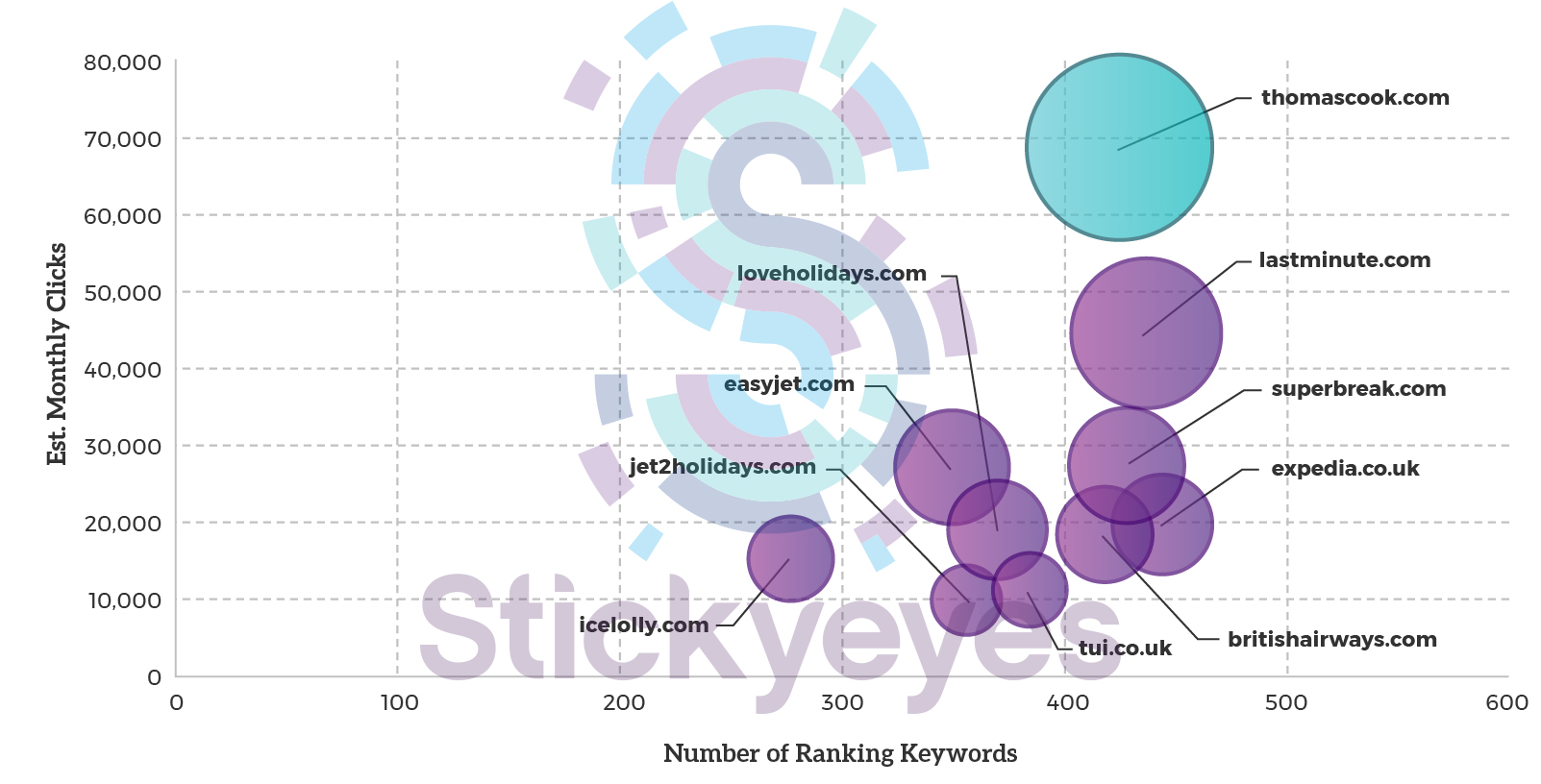

The scale of this becomes evident in the short break and city break markets, where we see that EasyJet, British Airways and Jet2.com (through the domain Jet2Holidays.com), appear prominently, all offering combined ‘flight and hotel’ propositions.

By packaging flight and hotel bookings in one propositions, the airlines are attempting to capture a greater proportion of a travellers spend. Whilst most DIY bookings will typically involve booking through separate websites for the flight, hotel and possibly car hire elements, many airlines are attempting to reposition themselves as destinations for all of these elements in one place.

That has a simultaneous benefit from the perspective of search.

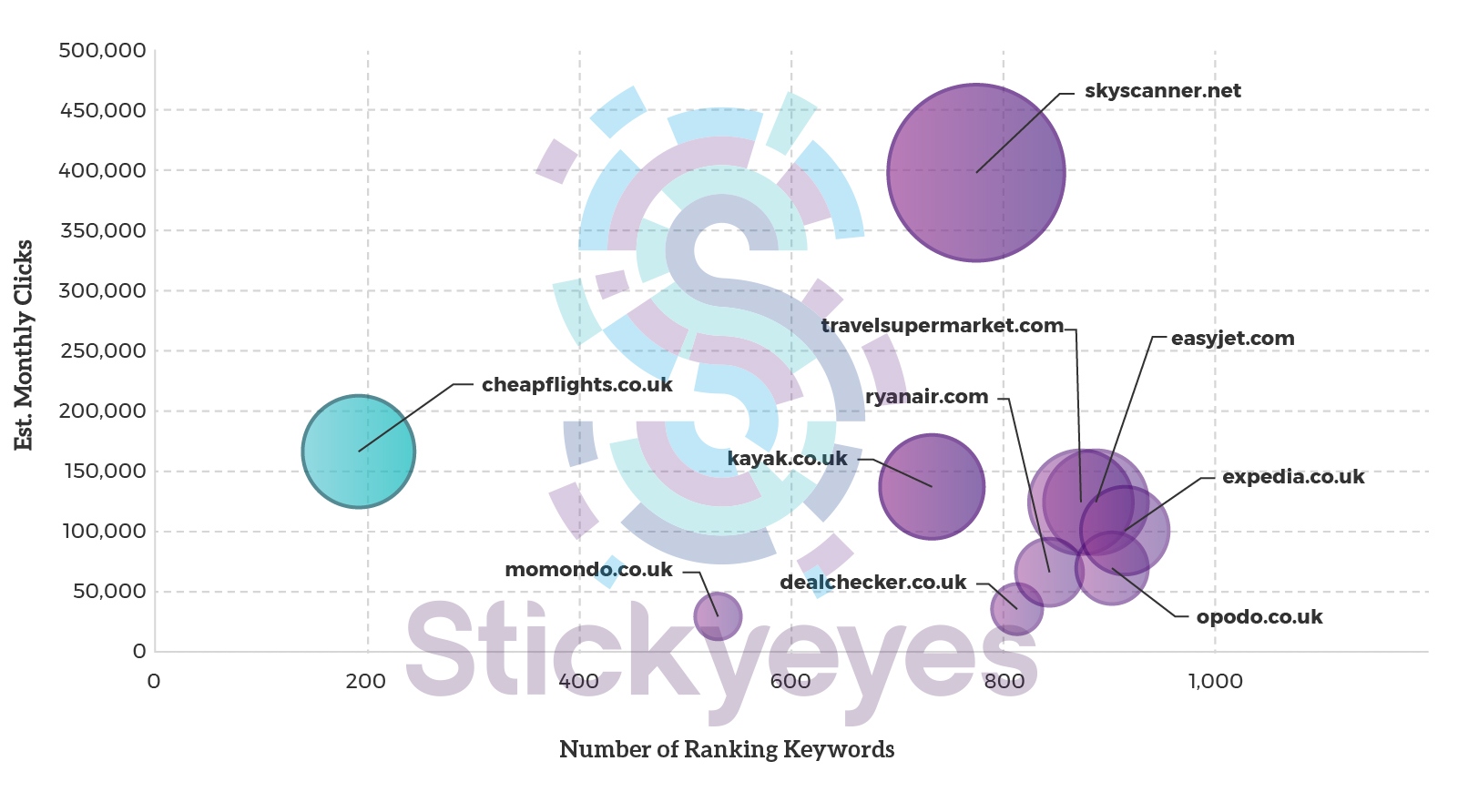

For some time, the flights market has been dominated by the price comparison websites and aggregators. Of the ten most visible brands in the market only two, EasyJet and Ryanair, are airline operators. The rest are price comparison or secondary booking agents.

For the majority of airlines, the likelihood of out-ranking these price comparison websites and booking agents is minimal at best. These brands satisfy both the demand from consumers for low-cost travel, and the desire for Google to provide an easy, independent way of meeting that consumer demand.

But where the airlines can compete in the search market is on those keyword terms that lend themselves to package-based or bundled bookings. As evidenced by the performance of some airlines in the short and city break market, the low-cost airlines can achieve rankings for ‘break’-related searches on the destinations that they serve far more easily than they can achieve rankings for ‘flight’-relayed terms.

Package holidays are part of the customer journey – their challenge is to fulfil every step

This isn’t to say that the tide has completely turned when it comes to package holidays vs ‘DIY’ bookings. DIY bookings still command significant market share in the holiday market.

But what our report shows is that interest for package-based holidays is both strong and showing upward trends, and the way in which consumers in this market appear to be searching lends itself to the package operators.

Consumers are increasingly looking for inspiration in this market, increasingly searching for holiday types, rather than for specific destinations. The rise of the all-inclusive holiday and the growth of cruising have both changed the search journey from one that was heavily destination-based to one that is focused on the nature of the holiday – at least at the early stages of the customer journey.

For the tour operators, the opportunity is there to inspire those audiences at those early stages. We have seen brands generate visibility through the use of strong content, particularly in high-value markets such as honeymoons, and that is being replicated by those brands across their different propositions.

The brands that can respond to this trend quickly are the ones that will be rewarded by greater search visibility, traffic and, ultimately, booking revenue.

The latest Stickyeyes travel and holidays report takes a closer look at the search strategies of some of the most well-known brands in the industry.

By looking at some of the most important keywords in non-brand organic search, this guide identifies:

The top 20 most visible travel brands online

Who is ranked in our top 20 and who has missed out?

The most visible brands in seven important sub-sectors

including flights, package holidays, cruises and honeymoons

Our recommendations for future growth

Where should you focus your attention next?