The US online sportsbook market is starting to come to life, as more and more states begin to permit mobile wagering. Punters are starting to really embrace the new, much more open market, and operators both in the US and from abroad are making big investments in the American market.

In our latest search marketing intelligence report, we tried to understand how those new trends were impacting the organic search markets. Here are five of our key findings.

As the legislative landscape changes, American punters are showing their interest in sports betting.

Since the Supreme Court overturned the Professional and Amateur Sports Protection Act (PAPSA) in 2018, states have moved to legalize sports betting and launch their own programs. Currently, 32 states have some form of legalized gambling, with 19 currently taking wagers electronically online.

The growing acceptance of online gambling in the US market is reflected in the level of online search activity around sports betting terms. The 2022 Super Bowl between the Los Angeles Rams and Cincinnati Bengals broke several betting records, and that is reflected in the levels of search activity around the Super Bowl LVI. Keywords relating to the Super Bowl saw around 2.37m searches ahead of the 2022 match-up – almost double the volume for the 2020 NFL showpiece, according to Google Trends.

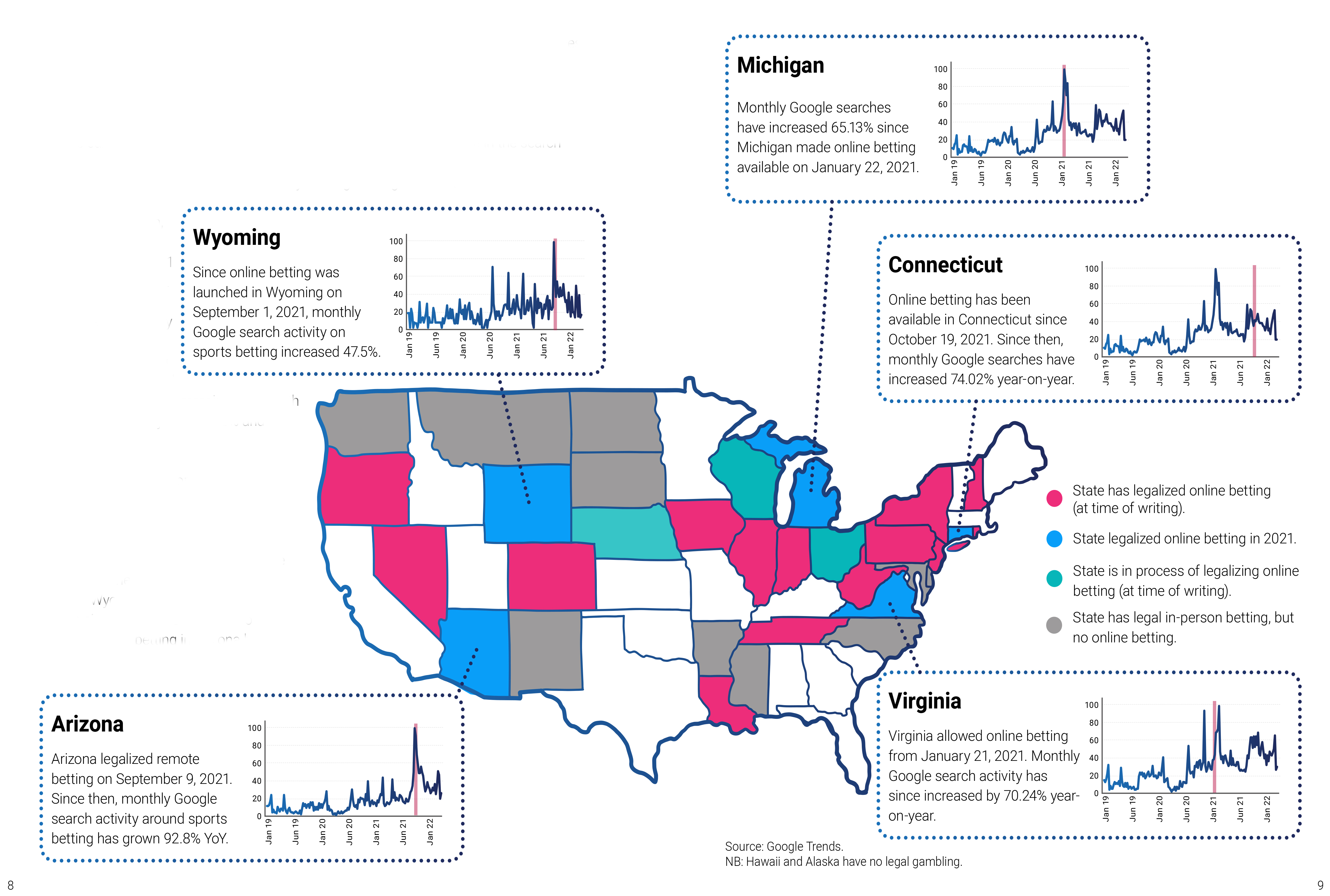

Of the 32 states that currently have some form of legalized sports betting, 19 allow for bets to be placed remotely online (with a further three at differing stages of the legislative process to allow for mobile betting). Five of those states, Arizona, Connecticut, Michigan, Virginia and Wyoming, legalized online betting at some point in 2021, providing us with useful case studies of how the legislative change has influenced demand from search users.

What we can see is that in all five cases, there has been a marked increase in the search volume around the subject of sports betting both in the months prior to the legalization of mobile gambling, and that increase in activity settling to a higher level than previous following that initial peak. In Michigan and Virginia, legalization of online betting in January 2021 coincided with the NFL post-season – a key driver of betting activity even in states without legalized online betting but even after that initial peak, search activity has remained high, with year-on-year uplift of just over 65% and 75% respectively.

Whilst the data sample for Arizona, Connecticut and Wyoming is smaller, with those states only legalizing online betting in the latter half of the year, there are still signs that sports fans in those states have embraced online betting. Monthly search activity in Wyoming has shown a 47.5% increase since legalization, whilst monthly interest in sports betting in Arizona has almost doubled.

No one brand is taking charge of the search results in the US.

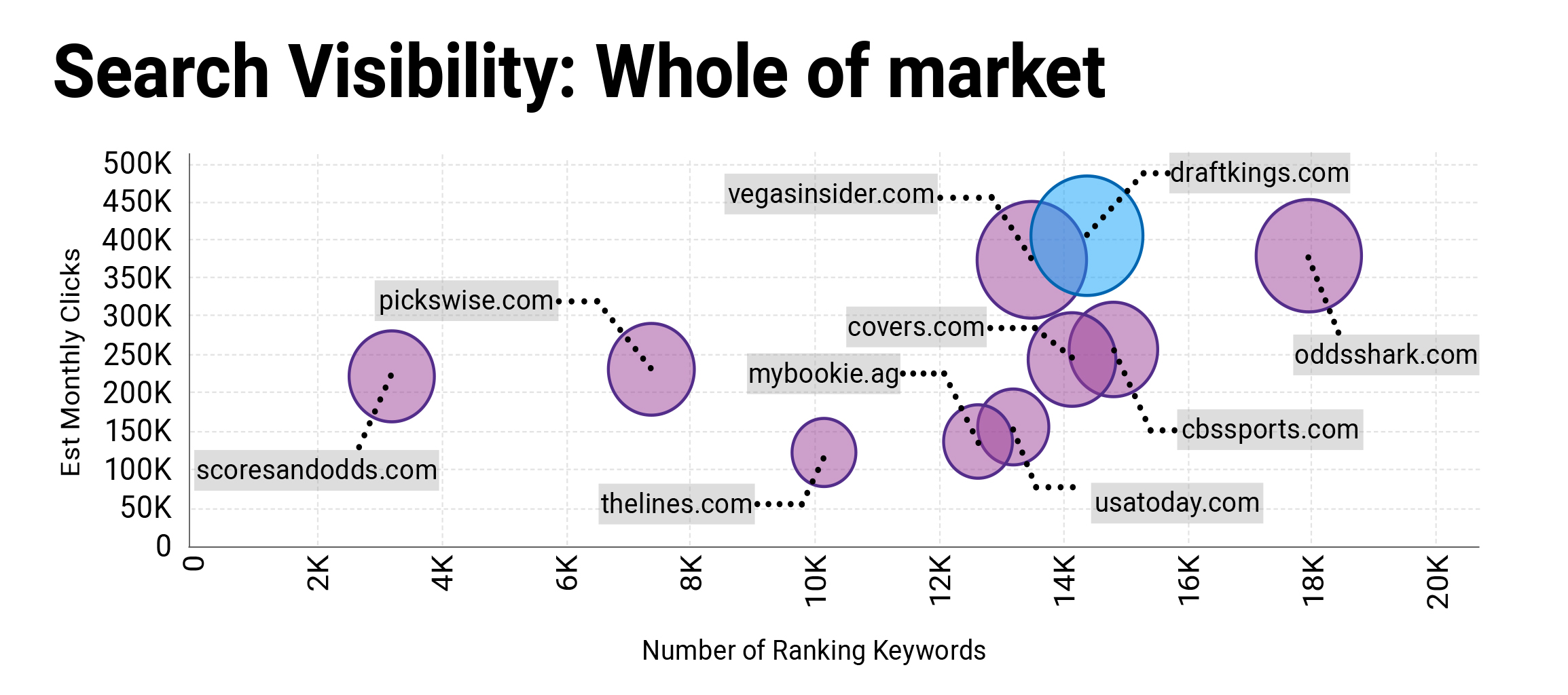

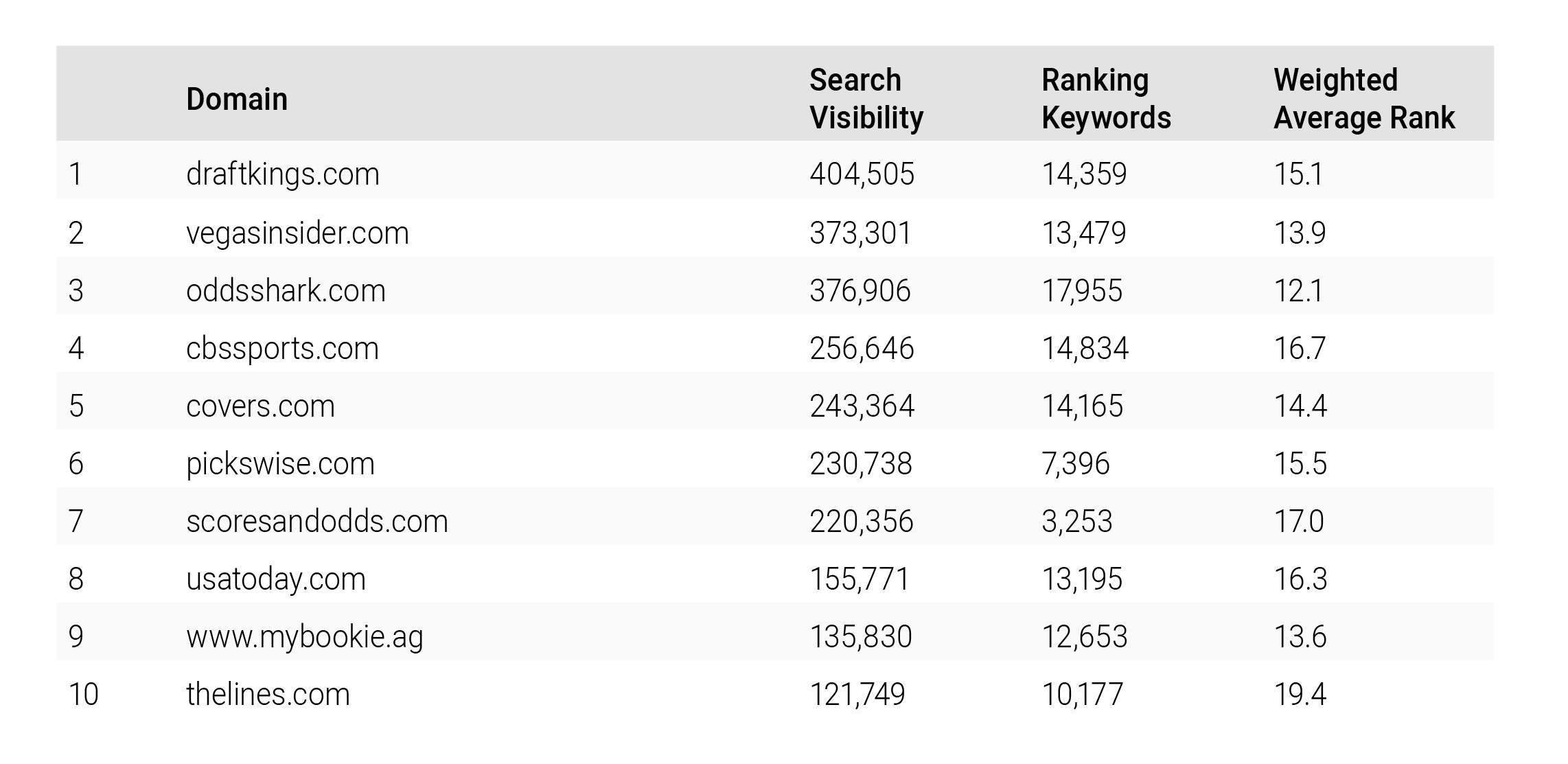

One of the key findings in this report is that no one brand is particularly dominant in either the market as a whole, or in any sport-specific category, and this means that there is a lot of untapped opportunity and potential in organic search.

The overall market leader, Draft Kings, commands just 22.9% of the potential maximum traffic in the US sportsbook market and doesn’t lead the market for any of the six sport-specific categories that we have analysed. To put that into context, we would typically expect the market leader in the UK to command somewhere in the region of 40-45% of the potential maximum traffic, and we would expect that brand to command a high percentage of the maximum available traffic in multiple sport-specific keyword clusters.

Instead, Draft Kings’ visibility is largely carried by generic betting and sportsbook terms and whilst this is clearly a positive for the brand, as there are strong levels of search volume in those terms, it does highlight just how much organic non-brand traffic that is still out there, waiting to be won.

The lack of any real market dominance is also true in the sport-specific categories that we have analysed, where the most visible brands also command a relatively low percentage of the maximum available traffic. In the six sports that we have looked at in detail, there are only two (golf and baseball) where the most visible brand in that category is taking more than 50% of the available traffic from organic, non-brand keywords. This effectively leaves the door wide open for any brand that wants to seriously invest in expanding its organic search visibility on a large scale and establish itself as one of the market leaders.

This makes it easier for affiliates and informational sites to command search engine real estate.

Because many sportsbook operators have yet to establish their online authority in this market, it has allowed informational sites, affiliates and broadcasters to command a large share of the search market.

These brands can do this by offering a stronger content proposition that meets many of the requirements of the Google EAT guidelines, delivering content that is impartial, balanced and relevant to the audiences that are seeking it. In the case of the broadcasters and news publishers, their associations with the respective sports that are established through media rights and their own partnership agreements also support their brand authority and online relevance in many of the keyword clusters in this report.

It means that the search results pages in the US are currently very different to the search results pages that we see in many European markets, particularly in the UK, where there are multiple competing sportsbook operators all generating a similar level of visibility, with only a handful of affiliate or publishing brands taking any meaningful share of search. As the market matures, we would expect the US organic search results to follow a similar transition to the one that we have seen in the more mature European markets, and it will be the brands that invest wisely in content, brand authority and relevance that will be at the forefront of that evolving search landscape.

The Google EAT guidelines mean that content is going to be crucial.

The way that brands will build that online authority and relevance will be rooted in how they approach core strategies and tactics for search engine optimisation, but content – both on and off-site – is going to be at the heart of any successful approach. Whilst the technical disciplines of search engine marketing will naturally be crucial, the nature of many CMS-heavy iGaming operator sites means that there is generally a level playing field in this sense. The difference maker is therefore often in the more creative elements of marketing and SEO.

In a new and growing market, off-site content will need to be at the heart of how brands expand their online footprint. This content will act as the conduit for earning the high-quality referrals that are needed to establish authority, naturally and sustainably expand backlink profiles and increase both audience reach and brand mentions across the web.

And brands will need to leverage cutting edge creative and content to better engage consumers and stand in what will be a very competitive marketplace. Whether that is content that eases the concerns of first-time consumers, or big-brand creative that can leverage online channels to capture attention, the brands that get this deployment right will be the ones that start to see their share of voice grow, allowing them to move to the head of the search results in this burgeoning sector.

Operators are making up for this with brand partnerships.

Whilst our report excludes the impact of brand, it is clear that brand does play a significant role in the market. Many of the biggest keywords in this market are brand-appended keywords and this is perhaps a reflection of the level of brand marketing activity that is taking place in the US market.

Partnership deals between iGaming brands and both the leagues and the individual franchises are now widespread, with both domestic and international brands agreeing sponsorship deals to enhance their brand presence in the US market. Overall, betting sponsorships in US sport are estimated to be worth around $400m annually (GlobalData Sport Intelligence Center, 2021), with William Hill, Betfair, Betway, 888 and Unibet amongst the European brands that have made significant partnership agreements with both sports and teams across the National Football League, National Basketball Association, National Hockey League, Major League Baseball, Ultimate Fighting Championship and Major League Soccer.

The emphasis on brand marketing is to be expected in a market which is only recently starting to open. These brand partnerships allow for iGaming operators to establish a level of recognition, trust and authority by associating with prominent partners that have national, and in many cases, global appeal and audiences. Over time, that enhanced authority and brand salience is likely to influence their online visibility for both brand and non-brand terms, and potentially change the face of the search results as they stand today. This is of particular interest when we consider that European brands currently struggle for visibility for non-brand terms. Of the brands that would be familiar to consumers in mature online sportsbook markets such as the UK and Europe, William Hill is the most prominent, but is only the 66th most visible brand in the US, generating around 22,063 monthly visits from organic non-brand keywords. Betway marginally behind with 21,974 and Betfair attracting just 6,895.

Over time, as brands from both the US and Europe become much more ubiquitous in the minds of the US sports fan, we would expect that search volumes for more generic terms increase and that, in turn, the market for that traffic will become much more competitive.

Download our free 42-page report.

As the US iGaming market opens up, just which brands are in position to take advantage of the new opportunities in organic search?

The Stickyeyes US Sportsbook Search Intelligence Report will highlight just how consumer search trends have changed as the legislative environment has evolved, highlighting the key opportunities for sportsbook operators, affiliates and publishers to drive traffic, and show which brands are at the top of the search results in the key market categories.

Having analysed close to 20,000 keywords in the homewares and home furnishings retail market, our 44-page report will reveal:

What does the search market look like in US Sportsbook?

What our analysis of nearly 19,000 keywords tells us about the state of search.

Which brands are leading the search results?

We reveal the brands that are currently leading the market and why.

How do competitors target those valuable consumers in search?

We look at the opportunities for brands in the US Sportsbook sector to grow their online presence.