Our latest ecommerce whitepaper discussed some of the key trends, forecasts and learnings for the retail, FMCG and consumer packaged goods sectors. These sectors have seen huge changes as a result of COVID-19 but just to what extent has the pandemic changed consumer behaviour?

Here are the five key findings from our research and what they mean for marketers in these sectors.

Consumer behaviour has changed, but there is much more to it than COVID-19

The COVID-19 pandemic and the subsequent lockdowns imposed by governments have undoubtedly led to a notable change in consumer behaviour. The pandemic effectively forced many consumers, including segments who had never dabbled in ecommerce before, to seek and purchase even the most everyday of products online and more and more.

Whilst it would be natural to look at the COVID-19 pandemic as something of a seminal moment in changing how consumers engage with brands and purchase in the FMCG and consumer packaged goods (CPG) sectors, the reality is that consumers were showing signs that their behaviours were changing long before this pandemic. The coronavirus pandemic may have provided the catalyst for much of the consumer behaviour we now see, but the evidence shows that consumer behaviour was already headed in the direction we now find it travelling.

As consumers we are now looking to be more informed about the products we buy – even relatively low consideration products where for so long, the key differentiators between products on the supermarket shelf were brand recognition and price.

Consumers are more undecided, they’re less wedded to brands than previous generations of consumer and they are looking to be more informed about which products are the right ones for them.

It has resulted in search becoming a much bigger part in the customer journey for CPGs. Consumers are not just researching brands, but the ability of products to fulfil their respective needs – particularly in the early stages of the customer journey.

Google searches in the UK that began with the phrase “shampoo for” were up 90% between 2016 and 2018, whilst searches appended with the phrase “to avoid” were up 150% in the same period, according to Think with Google.

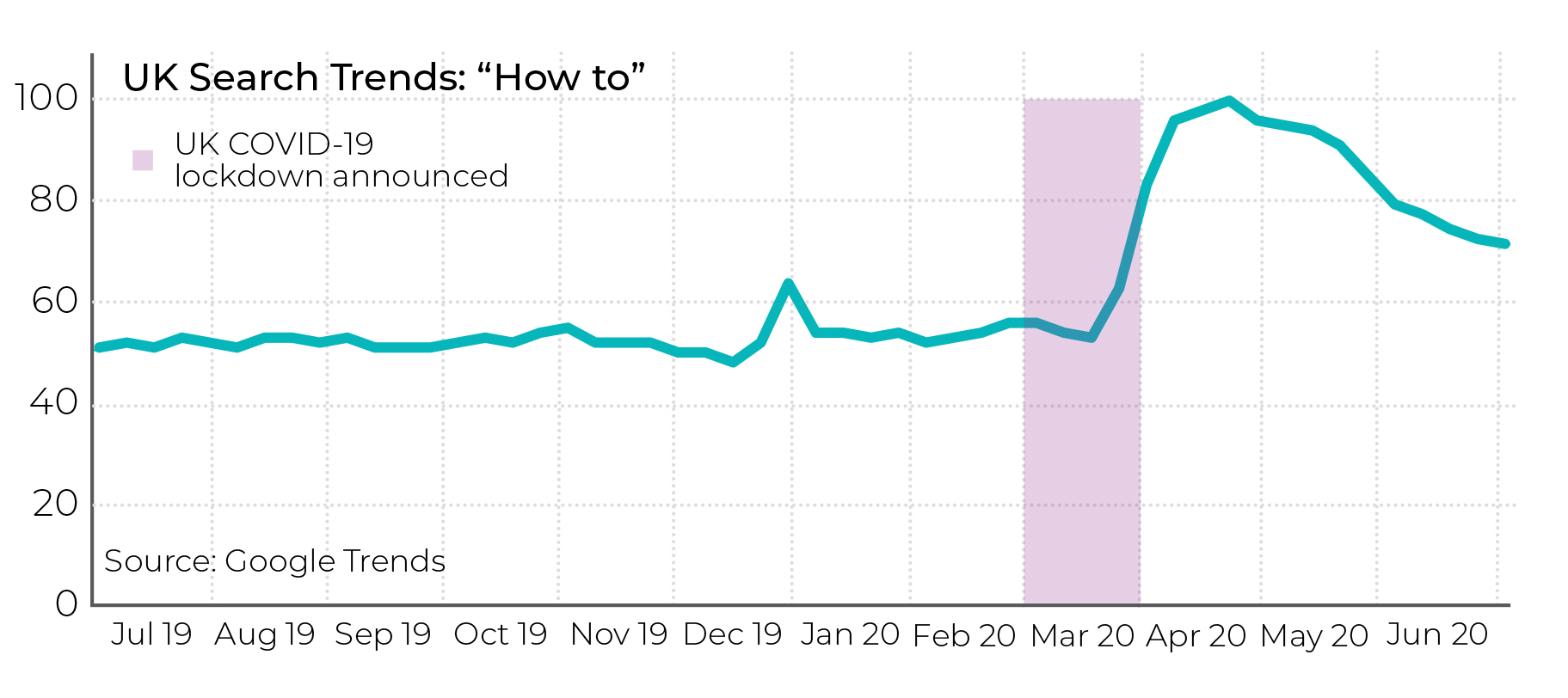

Searches appended with the term “how to” have also shown consistent growth over a number of years. The COVID-19 pandemic simply escalated that trend, as consumers were forced to ‘DIY’ many of the wants and needs of daily life.

Those trends tell a story of consumers who are not only undecided, but of consumers who are looking to be won over in different ways, using a greater number of touchpoints to find the right product for their needs.

We’re now taking the effort to learn more about whether products fulfil our needs, looking for social proof that Brand X is better than Brand Y and becoming more interested in the provenance and the credentials of products that we are buying.

It was those behaviours that created the environment in which direct selling business models could emerge and thrive, taking market share from established brands and manufacturers, particularly with more digitally active audience segments.

Direct selling and D2C brands have filled an important gap in consumer needs

It is that evolution of the consumer journey, and that increased propensity to question their purchases, that the direct-to-consumer and direct selling brands have been very quick to exploit. Whilst it is easy to see the growth of direct selling and D2C as a triumph of logistics, as crucial to their success has been the way that they have been successful in reassuring the consumer that their proposition is a better fit for their particular needs.

A growing segment of consumers are not simply looking for food for their dog, but instead food for their Labrador, Doberman or Sproodle. They aren’t simply looking to clean a carpet, they’re looking to clean red wine, curry, tomato ketchup or whatever they may have dropped.

These requirements are influencing how consumers search, going through different stages to narrow down the right product. The brand has become less important, whilst the credentials, suitability and provenance of the product has become more important.

Traditionally, brands focused excessively on the commercial part of the customer journey, neglecting those informational searches. That lack of visibility at the informational stages of the journey was arguably overcome by factors such as brand awareness, ubiquity and mass distribution, but those factors become less effective in the world of ecommerce.

Direct-selling and D2C brands have been particularly adept at understanding and catering to those search triggers and journeys, using search and content to position themselves as the right solution with engaging and insightful content for early-stage informational search queries, brands can establish themselves as authorities in their respective categories and reassure those audiences looking to purchase.

This behaviour is here to stay

Those who believe that this sudden COVID-19-infleunced spike in ecommerce and online activity may be in for something of a disappointment, because there is strong evidence to suggest that this behaviour is here to stay.

Necessity has quickly bred familiarity and, increasingly it appears, preference. Data from VISA reported a 41% increase in online purchases, with 74% of consumers likely to maintain those habits in the future. The EY Future Consumer Index on global behaviour suggested that more than half of consumers globally (52%) will change the way they shop, with 44% suggesting that they would do a greater proportion of their grocery shopping online.

Much of this growth is coming in product categories were not traditionally associated with ecommerce and online purchasing. McKinsey reports that the biggest growth areas in the UK for online retailing are set to be groceries, over-the-counter medicines, personal care, alcohol and household goods – categories where adoption of online shopping was generally lower, but where necessity has created a demand for online purchasing.

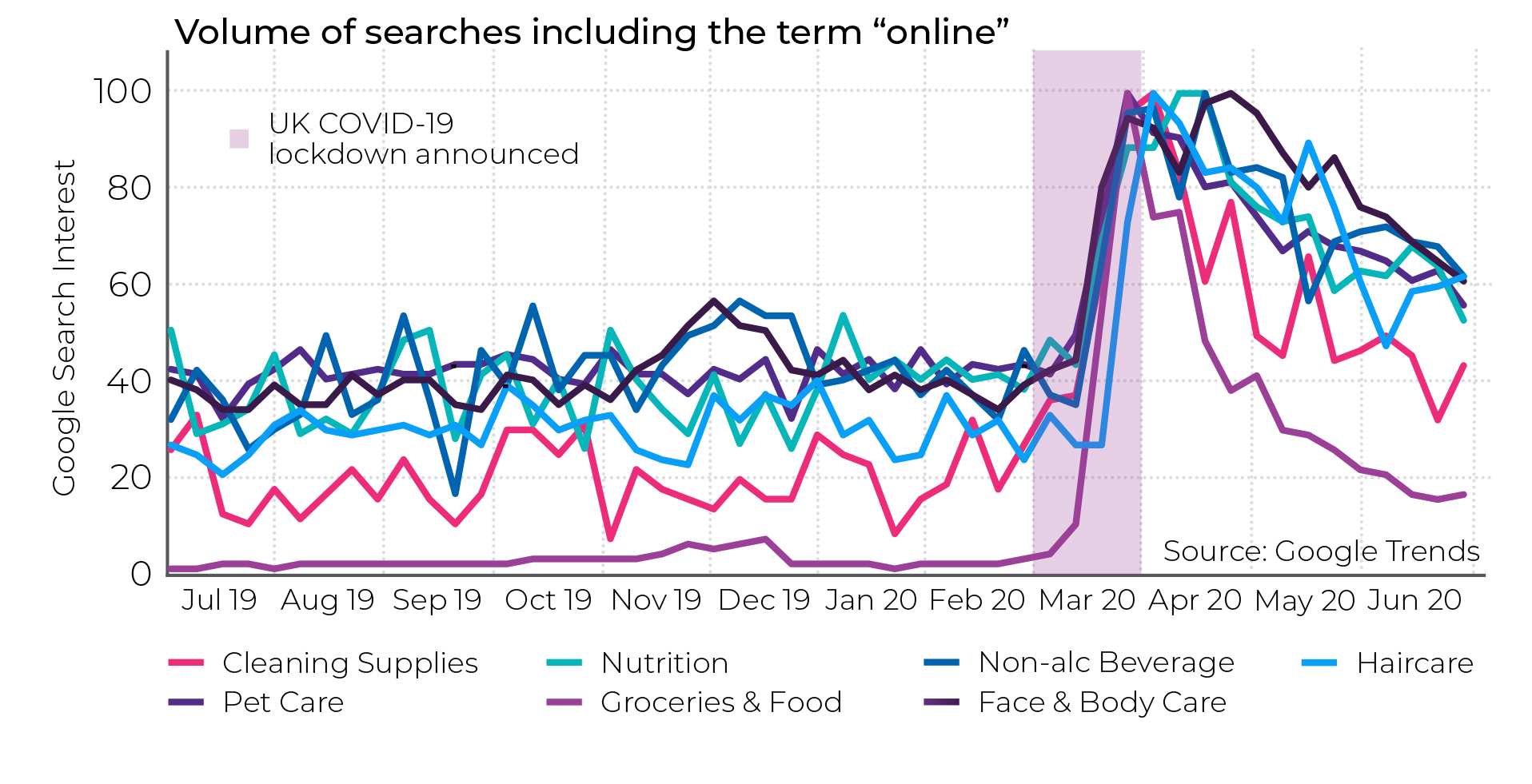

Google search data supports this finding. Search volumes for products and product categories that were appended with “online” (suggesting a desire to purchase products online) saw a significant increase in light of the COVID-19 lockdown and, whilst the volume has reduced as lockdown has eased, the decline has been quite gradual in many categories.

The COVID-19 pandemic may have accelerated many trending behaviours, but those behaviours look like they are here to stay.

Traditional brands have the authority to provide the assurance consumers are looking for

As consumers look to make more informed decisions about the products they buy, even for traditionally low consideration purchases, there is a growing demand for content that tackles common consumer questions and queries.

Whilst more agile, digitally-minded D2C brands have been quick to meet that demand, the good news for the so-called ‘traditional’ brands and manufacturers in the consumer packaged good sector, is that they are actually well placed to satisfy that demand, using their brand equity and expertise to provide content that guides and reassures consumers to make the right purchasing decision. These brands have the power of brand recognition, brand salience and reputation, giving them so much to potentially earn in those informational stages – as well as those commercially-focused searches.

By understanding the questions that your audiences have, identifying what triggers those questions and understanding how that translates to search behaviour, brands can engage consumers, build authority and drive sales both online and in store.

Brands need to own and digitise more of the customer journey

The retail industry is likely to see a dramatic shift following the COVID-19 pandemic and that is largely going to be driven by how motivated consumers are to visit physical retail outlets.

Many may remain nervous about crowded shopping malls and supermarkets. Others may have been permanently won over by the convenience of ecommerce.

Both of these scenarios mean that brands need to think about their customer touchpoints, reviewing how relevant each one is in this new retail environment, digitising those that can be digitised and reducing the reliance on those that can’t be.

We have already seen a shifting pattern of FMCG and CPG manufacturers taking greater control of the overall customer journey and several FMCG brands, either through start-up projects or through brand acquisitions, have embraced direct-to consumer ecommerce in many product categories, using alternative business models to overcome the challenge of more transient consumers and enhance overall customer lifetime value.

But even where D2C models remain challenging, it is important to think about those customer touchpoints that can be digitised (and investing in making those touchpoints more digitally focused) and identifying those that are more difficult to digitise (and looking at how consumers can bypass those touchpoints). In an era where retail footfall is likely to fall, product demonstrations are inherently more difficult and the retail experience becomes very different, the way you engage and sell to audiences needs to be able to shift to whatever behaviours consumers embrace.

Get your copy of our free ecommerce whitepaper.

The way in which consumers buy products is changing. The rule-book has been ripped up, the dynamics have changed and consumers are expecting more; more information, more convincing and more value. But, how can you make sure your brand is positioned to take advantage of these changing consumer behaviours?

By downloading this whitepaper you will find out,

-

-

- How to use content to engage your audience and take more control over the customer journey.

- How to innovate in paid search, Google Shopping and marketplace advertising to bring a direct selling proposition to market.

- How to drive more brand loyalty and enhance your customer experience.

- What strategic and tactical changes you need to make to navigate the short-term and ensure you have a platform for long-term growth.

-

Get your guide straight to your inbox now and start transforming the way you do digital.