The key Black Friday and Cyber Week retail period looked that little bit different in 2020 but online at least, it presented retailers with some very familiar challenges. How did retailers and ecommerce brands balance the challenge of driving sales and maintaining profitability, during a time of incredibly aggressive online advertising?

To try and answer that question, we monitored Black Friday and Cyber Week activity across more than 6,000 keywords, spanning the competitive categories of electronics, outdoor and homewares, to see how retailers were approaching this important sales period. In particular, we were looking to see if brands were successfully combining both organic search, paid search and Google Shopping listings to maximise their investment in digital during a week where advertising costs tend to see a significant uplift. Did brands play a longer-term SEO game or where they able to make up last minute ground through an ambitious PPC strategy?

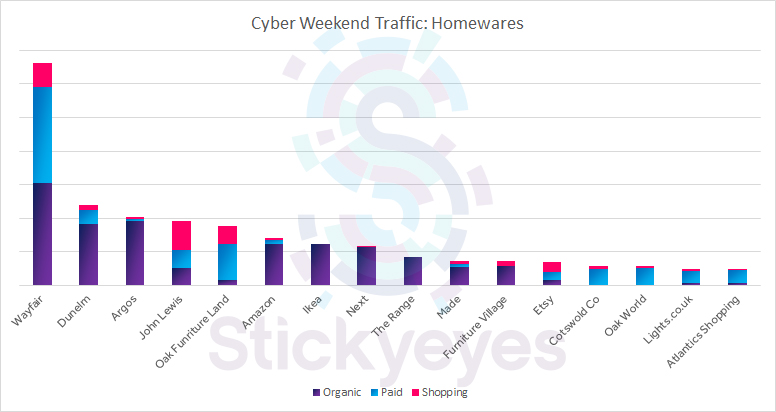

Wayfair leads in homewares

In a year defined by tiered lockdowns, travel restrictions and working from home, the homewares category has become increasingly popular with consumers over the course of 2020. Clearly time spent at home has encouraged people to spend on improving their home.

With stores across most of the UK closed over Cyber weekend, we expected competition in this landscape to be fierce and so a strong search presence was more important than ever.

Overall, from the period spanning Friday to Monday, Wayfair dominated the homewares search results across Google, with a strong presence spanning organic search, paid search and Google Shopping. We estimate that their traffic from our keyword set over Cyber Weekend was more than double that of their closest competitor, Dunelm.

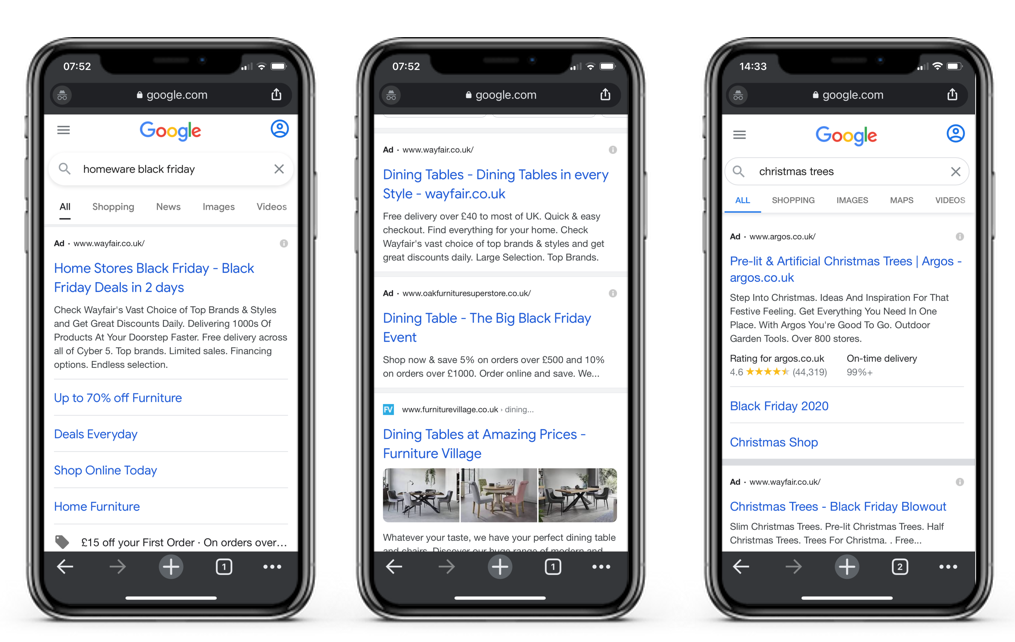

Whilst commentary on ad creative is naturally subjective and we did feel that other retailers did have stronger creative during this period, Wayfair did achieve a significantly higher overall coverage in the search results across all three channels. The brand ranked well organically for terms including “bedside tables”, “floor lamps” and “dining chair”, using paid search effectively to drive traffic for short-tail terms such as “wardrobes”, “dressing tables” and “wide tv stand”.

We saw other brands, particularly bricks and mortar brands, rely more heavily on their organic presence. Both IKEA and The Range were undetected across our paid keyword set, whilst Next’s results were negligible in the homeware space, with these brands instead appearing to adopt a more long-term approach focused on building their organic presence in this space and keeping their ad costs to a minimum. And whilst their paid investment was small, Argos took the top spot amongst our festive cluster – appearing for terms like Christmas trees.

Other brands, such as John Lewis and Oak Furniture Land, were able to punch above their organic weight through what we assume was a sizable investment in paid search.

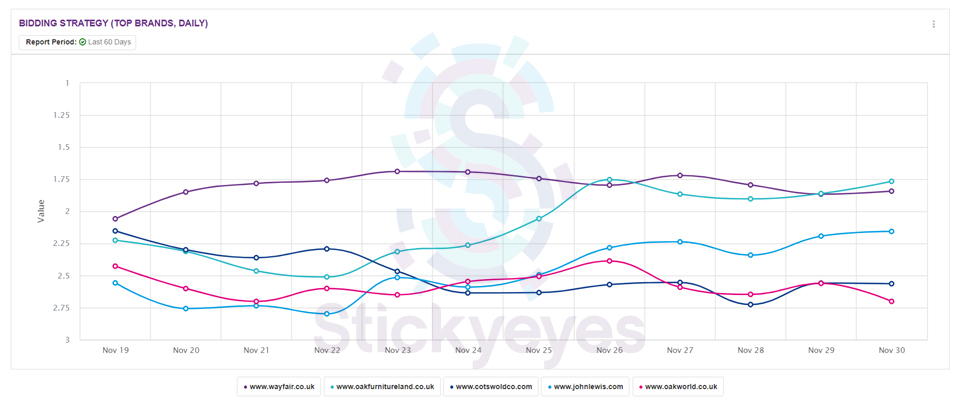

Oak Furniture Land was particularly aggressive on paid search over the Cyber Weekend itself. In the run up to Black Friday, Wayfair was the leading brand, thanks to constantly high average positions (appearing consistently in the top two in the week before) but Oak Furniture Land managed to achieve a stronger overall average position on ‘Cyber Thursday’ - and even took the top spot on Sunday.

John Lewis, on the other hand, was the only brand to rank above Wayfair in a category when it came to Cyber weekend traffic. Although Wayfair managed to show for a higher number of overall placements on most days, John Lewis was able to appear for high volume terms in the accessories category in particular, including lighting, mirrors and photo frames, leading to a higher number of estimated clicks.

Go Outdoors relies on organic, whilst Blacks uses paid to overtake Amazon in outdoors

With restrictions on travel, particularly overseas travel, in place for much of 2020 along with the closure of many leisure venues, Britain has seen an increase in the number of people looking to take advantage of the great outdoors.

This has clearly led to increased interests in the outdoor products category, encompassing everything from outdoor wear and hiking boots, through to tents and camping equipment, so how have brands and retailers tried to capitalise on this interest during the Cyber Week period?

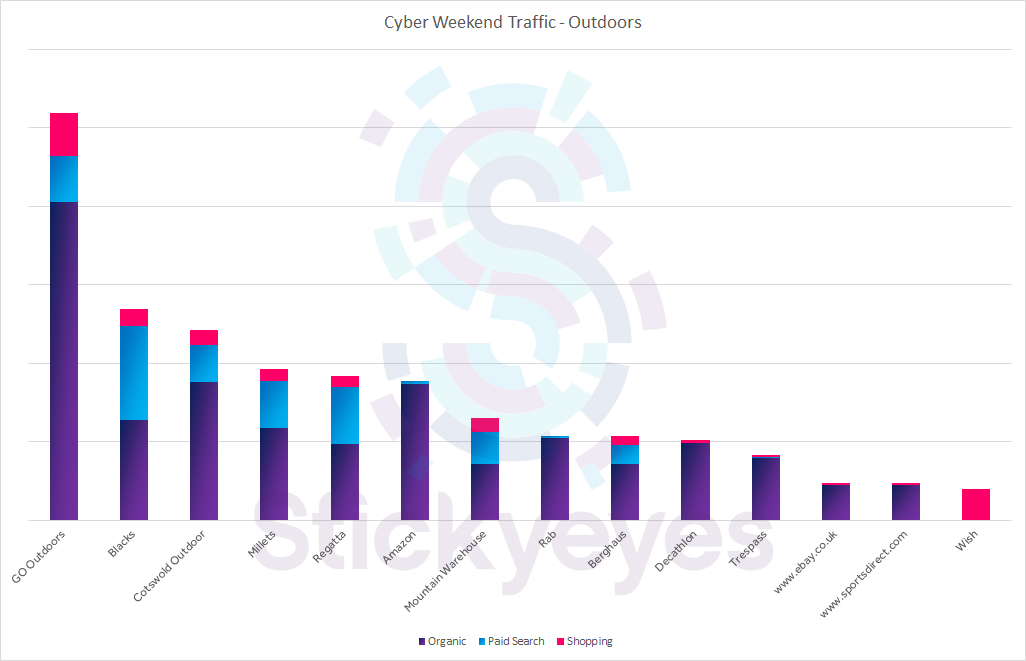

What our analysis shows is that a strong organic presence is vital in this market in order to underpin overall search visibility.

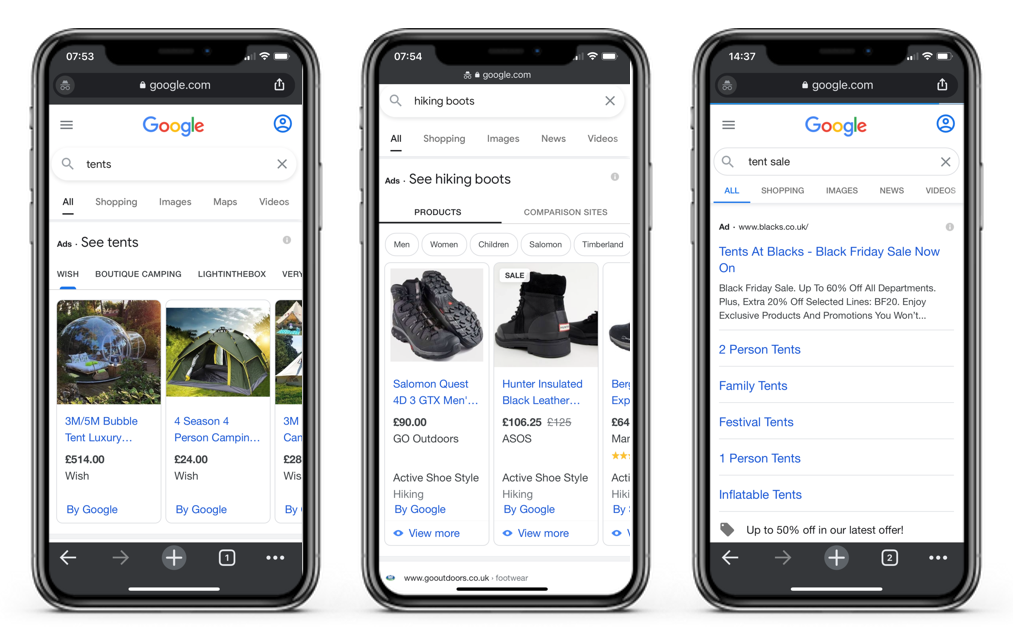

Go Outdoors was front runner in this market due to its organic foothold and relatively good coverage across both paid search and Google Shopping results. Some of its strongest organic rankings came from terms including “tents”, “walking boots” and “waterproof jackets”.

But as we saw with brands in the homewares market, many brands turned to paid search to enhance their visibility during this key trading period. This allowed some brands to overtake Amazon, which largely relied on its organic rankings in this market, in terms of search visibility. Amazon, of course, has the benefit of knowing that many users will go directly to the Amazon platform, rather than Google, to make a product search.

Of the brands that did use paid search to jump ahead of Amazon in the search results, Blacks was the most successful. The brand had the highest estimated paid traffic from our keyword set and we particularly liked the effective ad copy the brand was using, with prominence of their offer in headlines, descriptions and promo extensions, along with sitelinks that were exceptionally well tailored to the keyword.

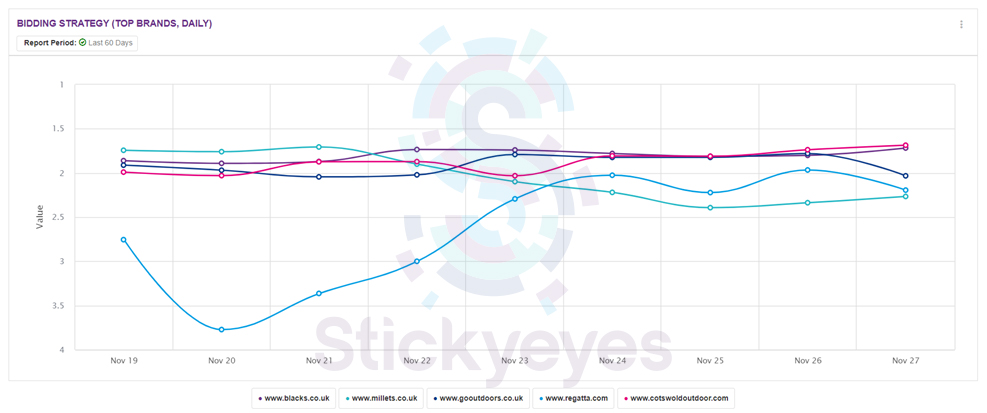

When it came to average position, Blacks held strong throughout the duration of Cyber Week. Millets began the promotional period as a front runner but was rapidly overtaken by brands such as Regatta, which increased aggression throughout the weekend.

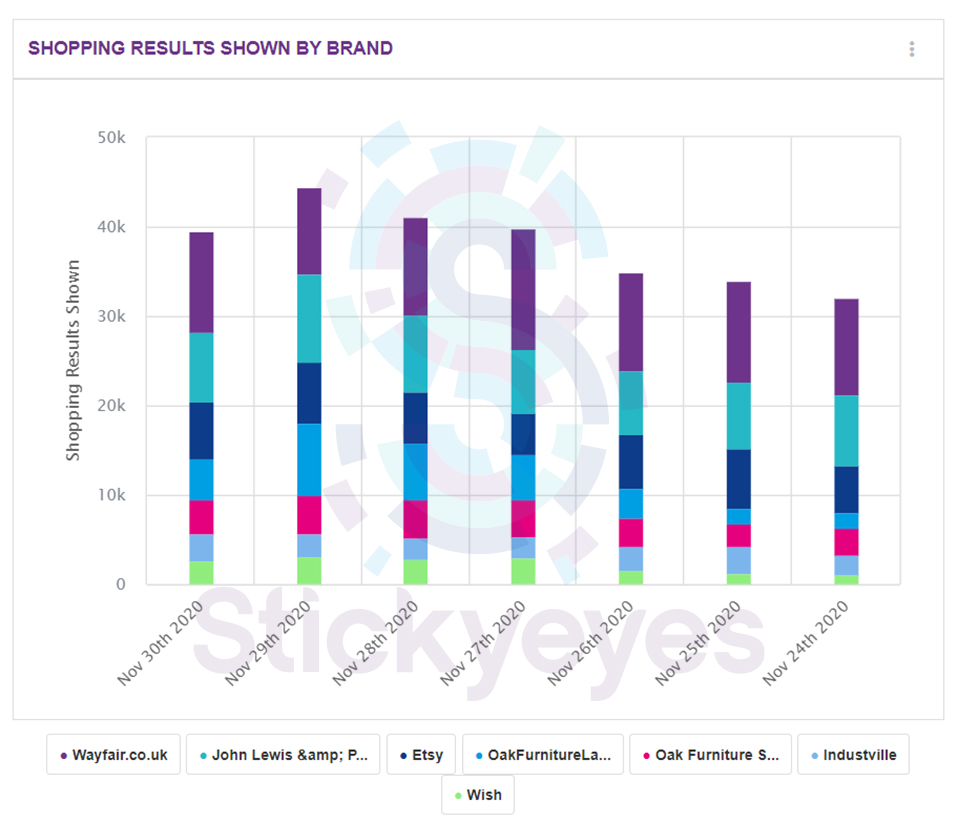

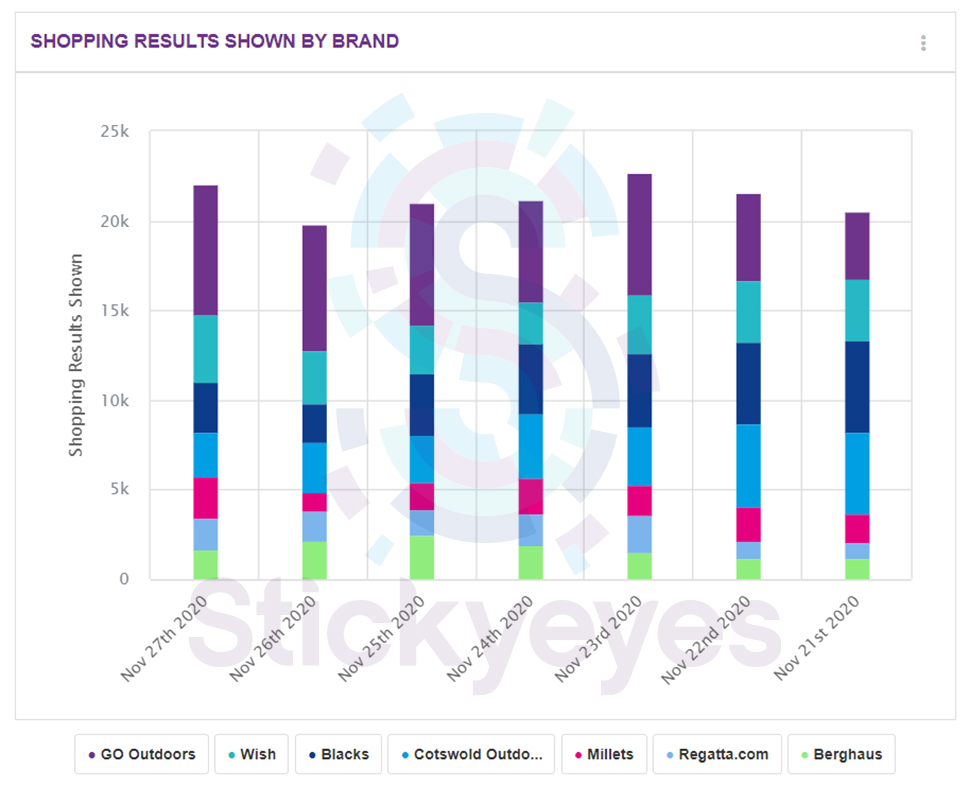

Interestingly, we saw that Wish was also able to command some search visibility through the use of Google Shopping campaigns, with the brand second only to Go Outdoors throughout much of the week.

Brand terms create fierce competition in an electronics sector where discounts are more selective

It’s difficult to think of Black Friday without thinking of the electronics vertical. In previous years we’d expect to see crowds of people queuing and pushing in store to bag the latest deal on a new phone or flat-screen TV, but that wasn’t an option in 2020. So what was the digital impact on the electronics sector?

This category is slightly different from the outdoors or homewares categories in that we expect many of the biggest keywords in the category to be branded product terms. This creates a fierce competition for visibility between the manufacturer brands and the resellers of those products. Indeed, the top twenty terms by search volume are all branded terms, rather than “generic” electronics keyword terms.

|

1 |

"nintendo switch" | 1,500,000 |

| 2 | "ps5" | 1,220,000 |

| 3 | "iphone 11" | 1,000,000 |

| 4 | "iphone 12" | 823,000 |

| 5 | "airpods" | 673,000 |

| 6 | "apple watch" | 550,000 |

| 7 | "fitbits" | 550,000 |

| 8 | "iphone xr" | 450,000 |

| 9 | "ps4" | 450,000 |

| 10 | "xbox one" | 450,000 |

| 11 | "iphone" | 368,000 |

| 12 | "iphone 11 pro" | 368,000 |

| 13 | "iphone 11 pro max" | 368,000 |

| 14 | "iphone se" | 368,000 |

| 15 | "playstation 5" | 368,000 |

| 16 | "xbox" | 368,000 |

| 17 | "iphone 8" | 301,000 |

| 18 | "iphone x" | 301,000 |

| 19 | "ps4 control" | 301,000 |

| 20 | "apple airpods" |

246,000 |

So, what did that mean for the search market over the Cyber Week period?

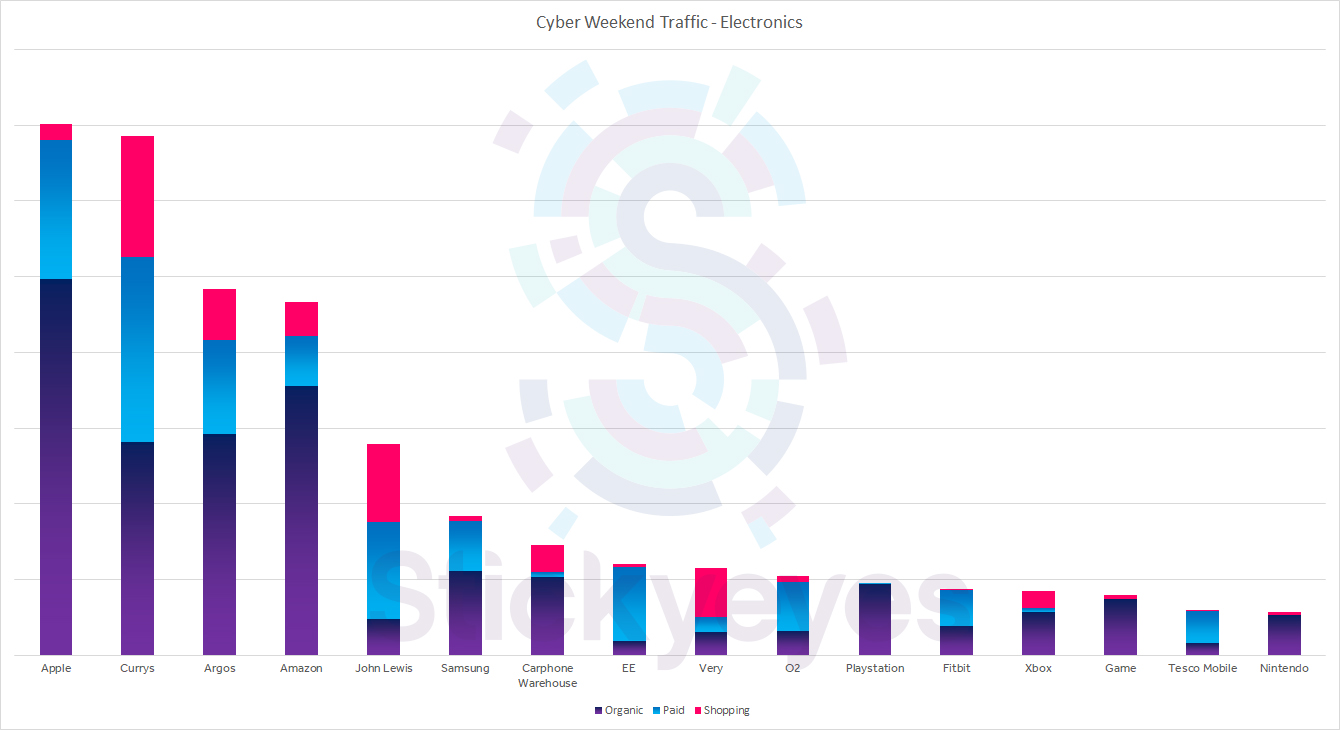

As we expect to see, the results are a mixture of brands and resellers. For the brands, Apple was the leader in terms of search visibility – a situation that was no doubt helped by the prevalence of high search volume terms relating to their products. Apple’s organic presence was supported by investment in biddable activity over the course of the weekend, with strong paid search visibility and a smaller amount of visibility achieved through Google Shopping.

We can also see Amazon as both brand and reseller, with Black Friday buyers looking for deals on Amazon’s own range of electronics (Echo, Kindle and Firestick products) and this allows Amazon to gain a large foothold in the search results organically. But as with the outdoor market, we also see that the investment in biddable is limited and again, this is likely influenced by the propensity of Amazon customers to go directly to Amazon, rather than through Google.

The electrical retailer Currys beat Argos to be the dominant reseller in our keyword set, although it did rely on biddable channels (paid search and shopping) to achieve this.

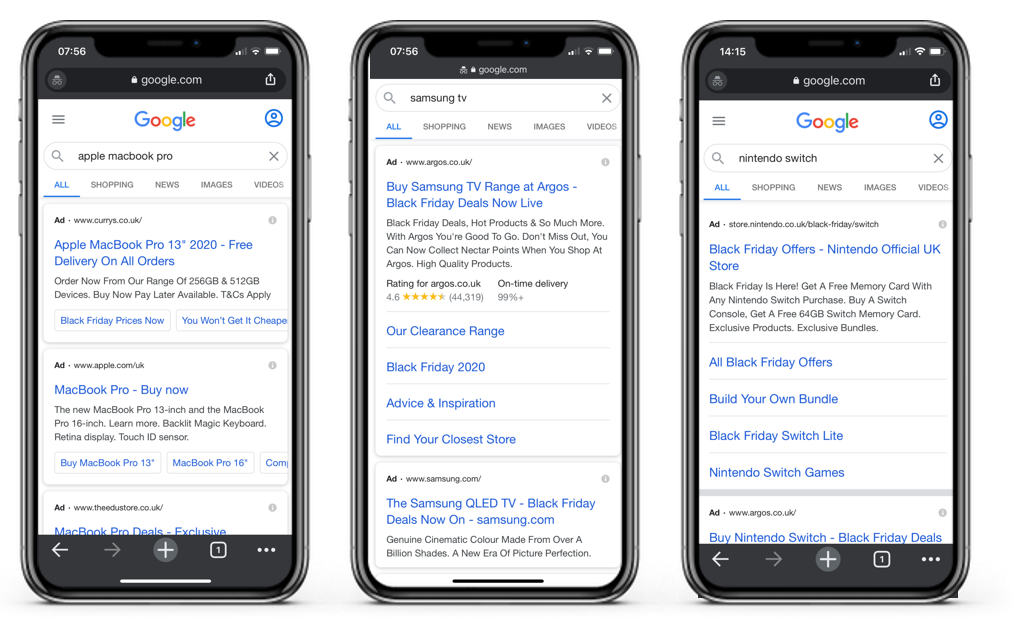

‘Black Friday’ specific messaging was less prevalent across tech terms, and this is something we commonly see as in this sector, Black Friday offers tend to be limited to a small subset of products. Where we did see references to Black Friday, it was usually in the context of a generic message, rather than any specific mentions of monetary or percentage discounts.

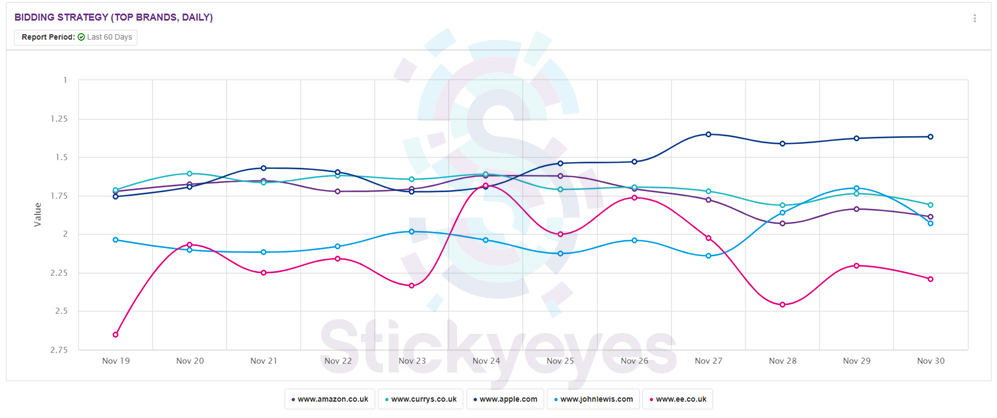

Of those paid search bidders ranking highly in the search results, Apple pushed clear from the pack from the Friday, holding an average position of between 1.25 and 1.5. A similar approach was taken by John Lewis, which upped its game from lower positions to above position two from Saturday onwards.

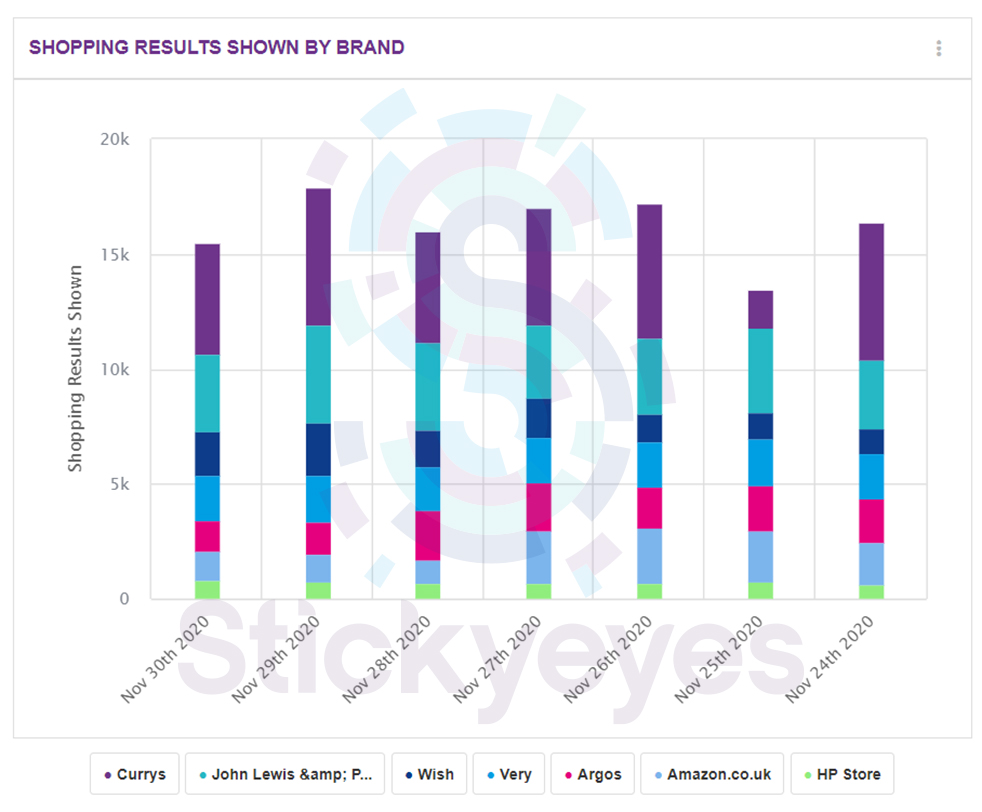

And as we saw across the homeware sector, John Lewis appeared to put a lot of its focus into its Google Shopping campaigns over the Cyber Weekend period – second only to Currys in terms of the number of Google Shopping placements. Other retailers such as Very and Wish again made some traction through utilisation of this channel, showing the growing level of importance for shopping as a channel when it comes to gaining that incremental volume.

Brands that succeed do so by using biddable to build on solid organic foundations

What this, and wider pieces of analysis show is that the brands that are able to succeed in the Black Friday and Cyber Weekend are those that can build upon solid organic search foundations with intelligent uses of paid search and Google Shopping.

At a time where ad costs naturally escalate due to the increased competition, along with a squeeze on margins created by heavy discounting, biddable media can only carry so much of the weight in your digital strategy.

All three channels need to be used holistically. Too much of an emphasis on those biddable channels invariably impacts margin, whilst not using biddable to “fill in the gaps” of your organic presence could result in brands missing out on valuable traffic. Brands need to build their organic presence ahead of the peak, giving them that strong organic foothold upon which they can add layers of biddable activity during those promotional periods.

We have also seen the increasing role that Google Shopping can play in the market and while the potential volume may be smaller, it has proven to be an important channel for relative “underdogs” to take some of that market share from the biggest players. As a keyword-less medium, an optimised feed and well-structured campaigns are a must but it really is a channel where anyone, big or small, can take part.