Black Friday week has grown to be arguably the biggest week in the retail calendar but amid uncertainty on the High Street, retailers seem to taking a much closer look at the bottom line, rather than the headline discount.

And that’s it! Another Black Friday has been and gone. Time for every paid search marketer to breathe a sigh of relief, grab a coffee and enjoy that brief moment of respite between one of the most hectic shopping weeks of the year and the last-minute rush of the Christmas period.

Black Friday weekend is undoubtedly one of the most competitive periods of the retail calendar, with brands and retailers fighting not only for as big a share of consumer spending as possible, but also for the digital real estate that gets those consumers browsing in the first place. So, which brands went big on Black Friday and which ones flew relatively under the radar?

We decided to look not only at who was going big on the Black Friday weekend, but how they were approaching this key period where ad expenses tend to go up, whilst profit margins come down. We looked at the biggest keywords in the fashion retail sector over the Black Friday period (Monday 25th November to Monday 2nd December to be precise), to help us understand who dared to compete in this noisy, yet valuable space.

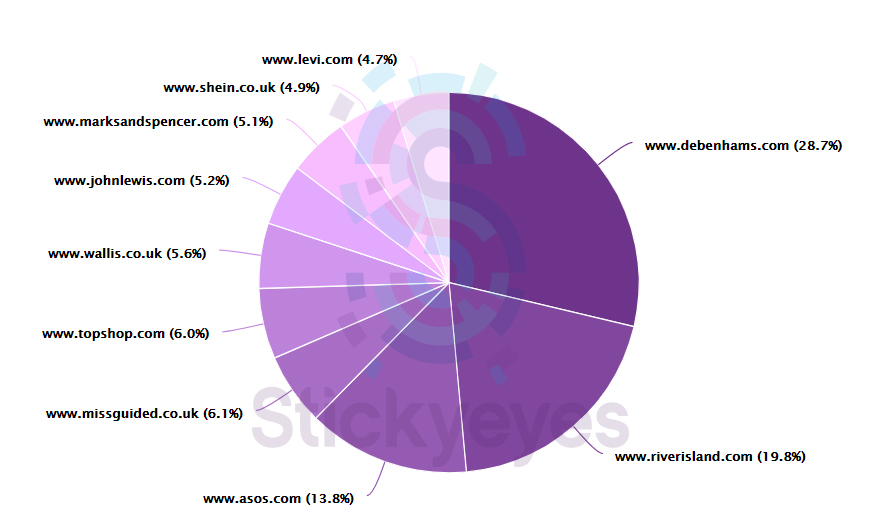

Debenhams leads the conversation

For the period as a whole, Debenhams was undoubtedly the most vocal brand on paid search for those high-volume fashion retail terms.

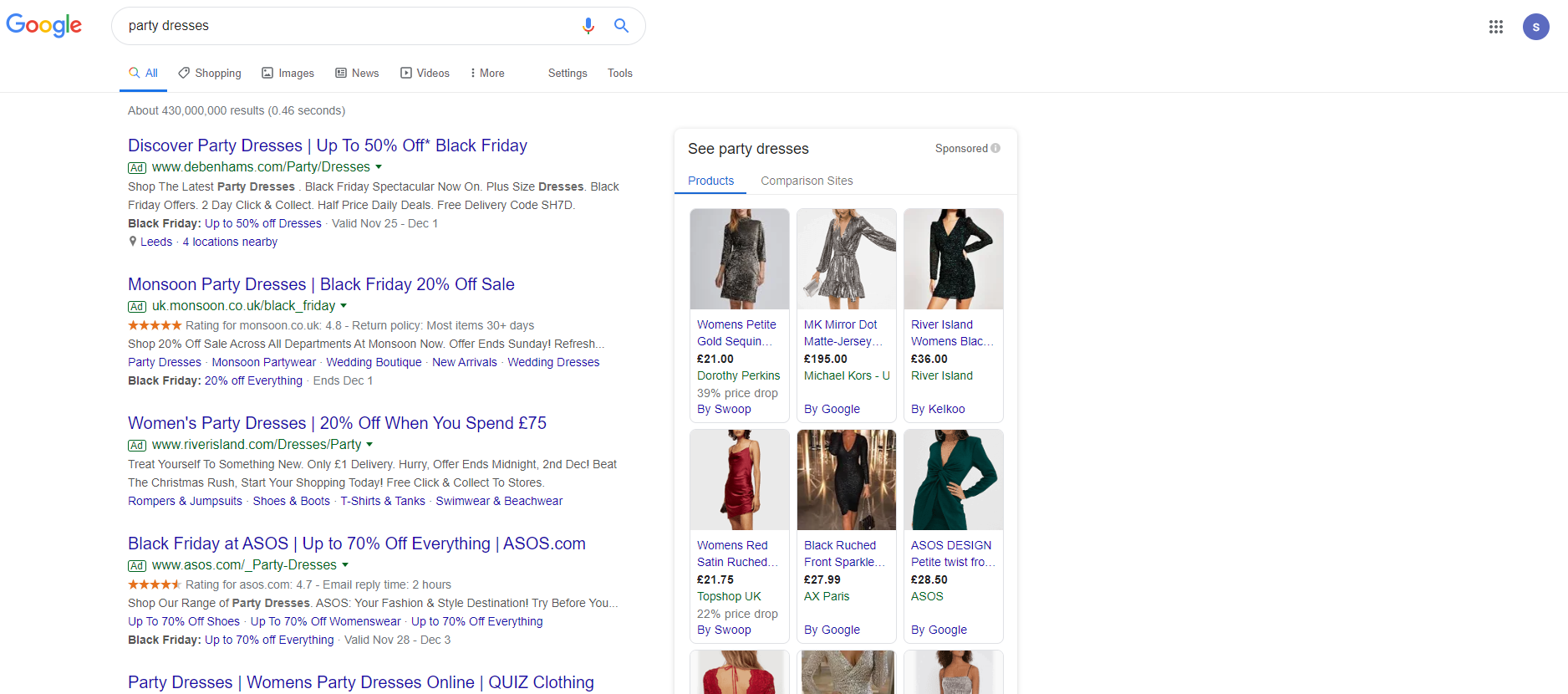

Debenhams seized a 28.7% share and an average position of 2.3, covering head terms such as ‘dresses’, ‘bodysuits’ and ‘skirts’. The quality of their ad copy was also impressive, with highly tailored copy for each search term not just in the first headline, but also in the description.

he brand’s headline discount, 50% off, featured prominently in the second headline and their copy was supplemented with a wealth of extensions, including location and promotions.

ASOS went big on Black Friday as resellers take strong positions

Resellers have long posed a threat to brands during Black Friday and other key promotion periods, often undercutting the brands with bigger and longer discounts, and that proved to be the case again in 2019 with ASOS and John Lewis joining Debenhams to see three resellers in the top ten for share of voice.

ASOS went into Black Friday particularly aggressively, claiming a 13.8% share of voice across the week, although this stood at 15% on Black Friday itself and peaked at 21.1% on Thursday.

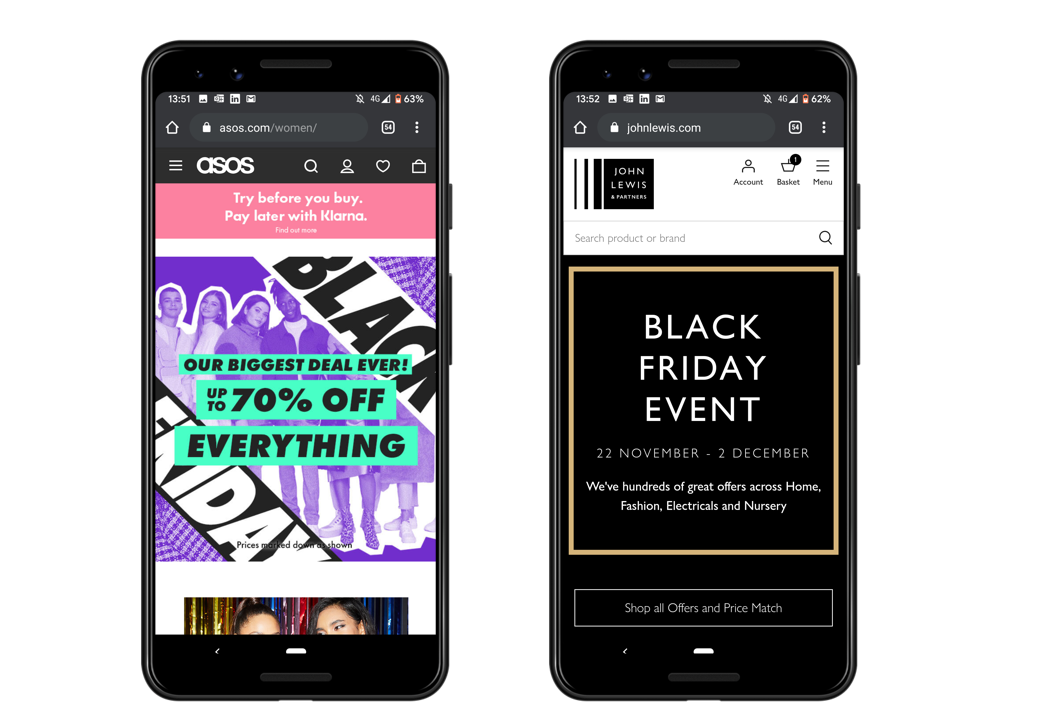

The brand pushed an enormous blanket discount of 70% off on everything – that’s right, everything and this aggressive discounting, coverage and messaging of “our biggest deal ever” demonstrated just how vital this period is for the E-tailer.

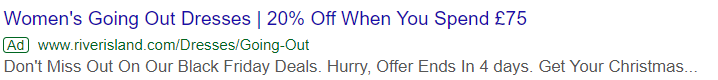

Party wear was a particularly strong area for the brand, with the brand enjoying top of page positions on terms like ‘going out dresses’, ‘Christmas party dresses’, ‘sequin dress’ and ‘glitter dress’.

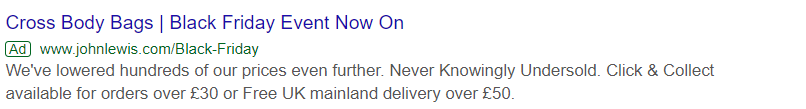

John Lewis took a very different approach to ASOS, simply referring to a “Black Friday Event” rather than a specific headline discount. Indeed, many rotations of their PPC messaging didn’t even go this far, retaining a very BAU, non-Black Friday message.

High street heavyweights go head to head

Away from the resellers, both TopShop and River Island both had noteworthy approaches to this key retail week.

River Island commanded 19.8% share of voice, competing with ASOS in the party wear category and regularly achieved position one ad placements for high volume terms like ‘knee high boots’.

The brand used highly tailored content and countdown customisers to give their ads impact, whilst keeping margin at the forefront of their strategy by setting a minimum order value before a discount is triggered. This is certainly an interesting approach and, given how margin is now very much a key issue for many brands amid a culture of discounting, could be something that we see more of in other key promotional periods.

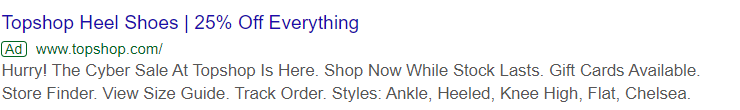

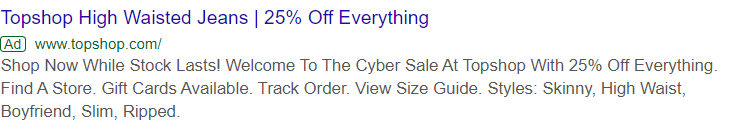

Topshop on the other hand was less aggressive on paid search, taking just 6% share of voice. However, relative to other brands, this was offset by a push on coverage earlier in the week – their 25% off promotion starting on Wednesday 27th November. For this day, their share of voice sky rocketed to the top of the leaderboard, claiming 23.4%. And who can blame them? Their punchy sitewide discount stood out amongst brands who didn’t launch offers until the Thursday or Friday. They also seemed to be testing three description rotations, all of which focused on driving a sense of urgency.

Competition in the fashion sector shows no sign of abating

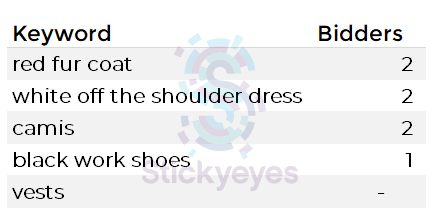

Competition in the fashion market, particularly around this key trading period, continues to be fierce. ‘Blouses’ was the most competitive keyword, with 51 different domains appearing in paid search across the Black Friday week. ‘Party dresses’ saw 47 bidders, ahead of ‘womens day dresses’ with 45.

Unsurprisingly, summer-focused fashion terms, such as like ‘camis’ and ‘vests’ had little to no detected bidders.

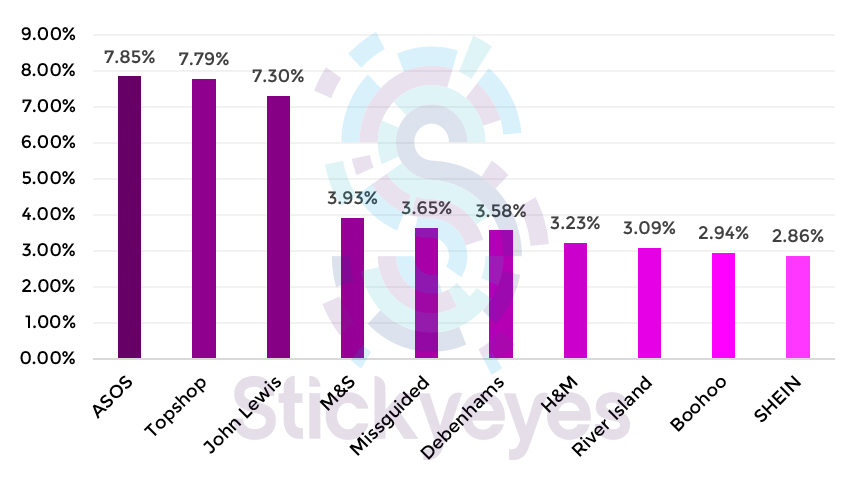

Our paid rankings tool also tracks the shopping landscape across the given set of keywords and, during the Black Friday period across our keyword set, the tool detected almost 150,000 shopping ads. This time it was ASOS who came out on top, taking over 11,000 of these spots, with strong coverage on terms like ‘blue mom jeans’, ‘floral maxi dress’ and ‘embellished dress’. Their reign was heavily weighted towards Cyber Weekend.

John Lewis, however, topped the chart in the earlier part of the week (peaking on Tuesday with 8.21% share). Topshop’s decision to launch their promotion on the 27th November also saw them enjoy significant levels of prominence, taking a 23% share of all tracked shopping placements on that day.

Debenhams, on the other hand, who came out on top from a search perspective, only covered 3.58% of our tracked shopping placements. Interestingly, they started the week closely behind John Lewis with 6.93% share but dropped as the competition began to hot up towards Cyber weekend itself, with a particular low of 2.15% on the Saturday.

What can we learn from Black Friday 2019?

The role that Black Friday plays in the UK retail scene, whilst often maligned, is certainly significant. Whilst many retail brands have bemoaned the ‘race to the bottom’ and the risk to margin that the spending frenzy encourages, there is remains an insatiable appetite and an expectation from consumers for big discounts.

Prior to Black Friday, we talked about the importance of retailers taking a longer-term outlook when it comes to their Black Friday strategy. We highlighted how brands needed to think carefully about their approach to avoid burning the candle at both ends – losing margin at one end from higher costs, and from the other end with overly aggressive discounts.

It was interesting that two High Street retailers, TopShop and River Island, took a more strategic approach. For TopShop, it was about stealing a march on the competition, launching their campaign early and capitalising on cheaper ad inventory.

River Island’s approach, which saw them push for higher basket size and order value by only triggering discounts at a minimum spend threshold, was clearly made with protecting margin in mind.

Black Friday and the ensuing weeks have sometimes made it all too easy for retailers to find themselves stuck on a treadmill of discounting, particularly as nervous CFO’s look over the Christmas sales projections in a difficult retail environment. What we have seen this year is that, whilst there are still some extremely aggressive tactics and strategies for this period, many brands are showing much more restraint and strategic awareness to ensure that, above all else, they remain focused on the bottom line.